Good afternoon pensioners. You probably already know my epic with pension money and that I have decided to withdraw funds from the second pension pillar. If not, I recommend reading previous article, so that all the text here does not seem incoherent to you.

On September 2021, XNUMX, my black iPhone X alerted me with a pleasant sound when funds were in my account.

I received 16201,68 euros on my account. At the same time, 4050,42 euros have already been deducted from me as income tax. The amount is certainly large, but a lot of work has been done :). Now the question is what to do with this amount next?

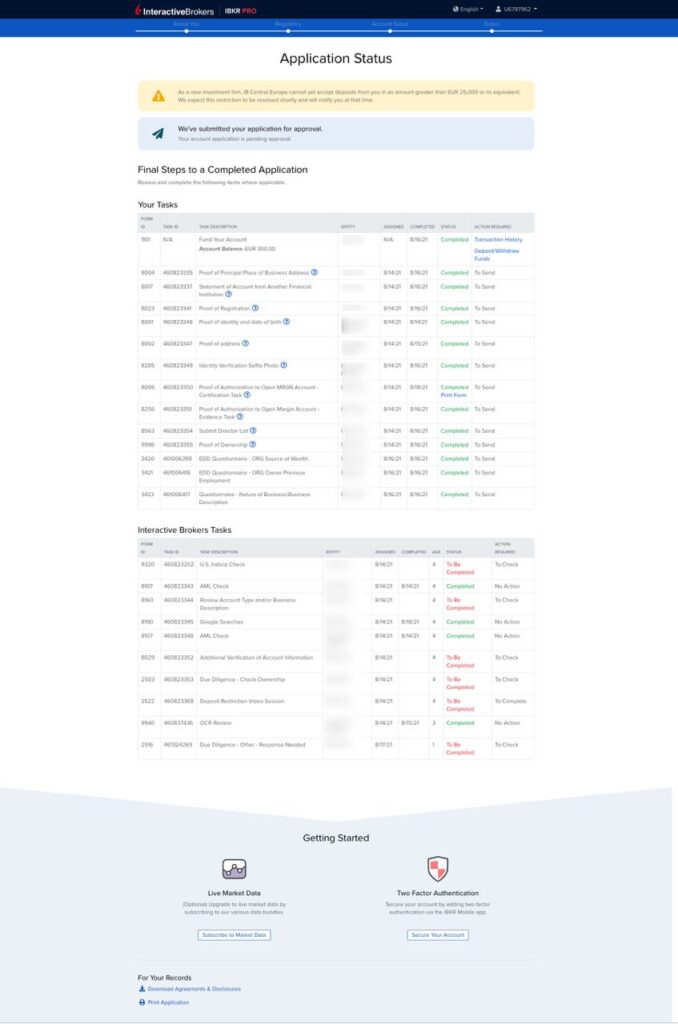

I've already prepared. Opened a company, set up accounting, opened an account with Interactive Brokers for a legal entity. It turned out to be that epic.

The fact is that Interactive Brokers wants to check a lot of things and the whole procedure took me about 2 weeks. I had to open a company, make an LEI code for it, fill out 10 thousand papers for Interactive Brokers, and in the end, after 2 weeks or maybe even a little more, the account was finally opened! As you can see from the screenshot above, quite a few checks were passed.

At the time of receipt of pension money, everything was already prepared and the company is only talking to give it money and start sending all pension finances to risky assets :).

But one thought came to mind. Let's validate, but shouldn't we put everything into real estate? Thought - done. Immediately knocked out their financial debts and obligations, calculated the total income, wrote and talked on the phone with the bank and sent an application. I wonder what will happen next 🙂

I do not deny that the original plans were slightly different, namely investments in stocks and ETFs, but real estate has always been in my field of vision and once I have already succeeded earn 44 euros actually from 866 in 0 years. Profitability here turned out to be cosmic.

Speaking of profitability. Those who have left all their money in PIK or in the second pension pillar are already winning 200% each month from their deductions. No financial instrument (almost :)) will make you such a return. Here is an example. You earn 1000 euros, the state will transfer you 40 euros (4% of 1000) with your investment of 20 euros (2% of 1000). It turns out that you tripled the amount of your investments in the first month (from 3 to 20 euros). How do you like that? Where will you triple your investment in a month? Right, almost nowhere :).

Therefore, I want to see what is happening with real estate and our banks. Will they let me buy an apartment with my solvency and pension money and if so I'm sure I can beat 200% by betting on the right asset :). This will be the mathematical salt of the word almost above :).

What are your plans? What do you do with your retirement money? How do you like my experiment?

logical. Why do you need a separate company to invest in real estate? and for shares, why doesn't a private person work better?

Kind!

A company to simplify the declaration and not to pay taxes immediately.

Real estate and the company are not connected moments with each other, I will take real estate for a private person

Good afternoon!

Are you planning to buy real estate through a company?

Kind!

No, such loans will not be given to the company. The company is new and does nothing.