Biotechnology studies the possibility of using living organisms to solve certain technological problems. This is a science at the intersection between something biological and technological, with its help the modification of the genome of animals and humans, the creation of new plant species, the provision of medicines, and the improvement of the quality of food products take place.

If we give specific examples, then with the help of this science it is possible to edit the human genome so that it becomes resistant to HIV infection and this is not a fictitious argument, but quite a real case, which you can read about, for example, here.

That is why biotechnology is a direction that is also one of the first to change the world. If at the stage of the birth of this industry, mankind used it only to increase production in the food and rural industries, now the main task of biotech is the creation of drugs against serious diseases such as Alzheimer's.

And Alzheimer's is not the only disease biotech has focused on. Scientists in this field tend to deal with issues of a global nature, such as the aging of the world's population. The UN is already concerned about the rate of population aging in this report, biotechnologies, perhaps, will give hope to slow down the natural processes of population aging. This is what biotech is interesting for - this is what a person creates in order to change, what would seem to be beyond his control. This is what makes investing in biotechnology very interesting and risky at the same time.

It should also be noted that local Estonian banks believe in the power of biotechnology and almost every Estonian bank (and not only) has a biotechnology fund in its portfolio (one example).

The biotech market size was estimated to be around $497 billion in 2020 and is projected to grow at a CAGR of over 9,4% between 2021 and 2027 according to the report. Global Market Insights. The industry is also actively supported by billionaire millionaires, the founder of PayPal has invested more than $ 17 million in a biotechnology company (link here).

Ok cap, what's next?

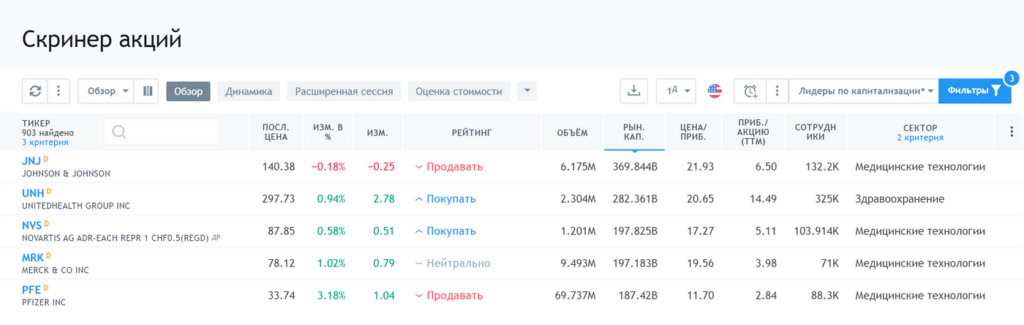

There are many biotech companies that trade on the stock markets, according to a stock screener. finviz has 657 biotech companies listed on the stock exchange. On tradingview, you can also see the entire list of biotech companies in the stock screener:

Shares of many companies can be found in Revolut (open to investors in the European market). There are JNJ and BIIB and PFE. But here is a list of interesting positions:

| Ticker | Year of foundation | Qty. collaborator | Capitalization | Share price* | Revenue | Profit |

| Amgn | 1980 | 22k | 135 billion $ | $ 235,15 | 25,43 billion $ | 7,26 billion $ |

| ABBV | 2013 | 30k | 197 billion $ | $ 111,4 | 45,8 billion $ | 4,62 billion $ |

| JNJ | 1886 | 134k | 437 billion $ | $ 166,2 | 82,58 billion $ | 14,71 billion $ |

| Biib | 1978 | 7,3k | 43 billion $ | $ 286,1 | 13,4 billion $ | 4 billion $ |

| Pfe | 1849 | 117k | 219 billion $ | $ 39,14 | 41,91 billion $ | 9,62 billion $ |

AMGN – Amgen is committed to unlocking the potential of biology for patients suffering from serious illnesses (oncology, arthritis, how much and more) by discovering, developing, manufacturing and delivering innovative human therapeutics.

ABBV is one of the largest companies in the world in the biotechnology sector. The company offers HUMIRA, an injectable therapy for autoimmune and intestinal diseases. SKYRIZI for the treatment of moderate to severe plaque psoriasis in adults. RINVOQ, a JAK inhibitor for the treatment of moderate to severe active rheumatoid arthritis in adult patients. IMBRUVICA for the treatment of adult patients with chronic lymphocytic leukemia (CLL), small lymphocytic lymphoma (SLL), mantle cell lymphoma, walden.

JNJ - The company has over 250 different subsidiaries in different parts of the world. The company develops many areas and medicines in the areas of immunology, neurology, oncology. They are also dividend aristocrats.

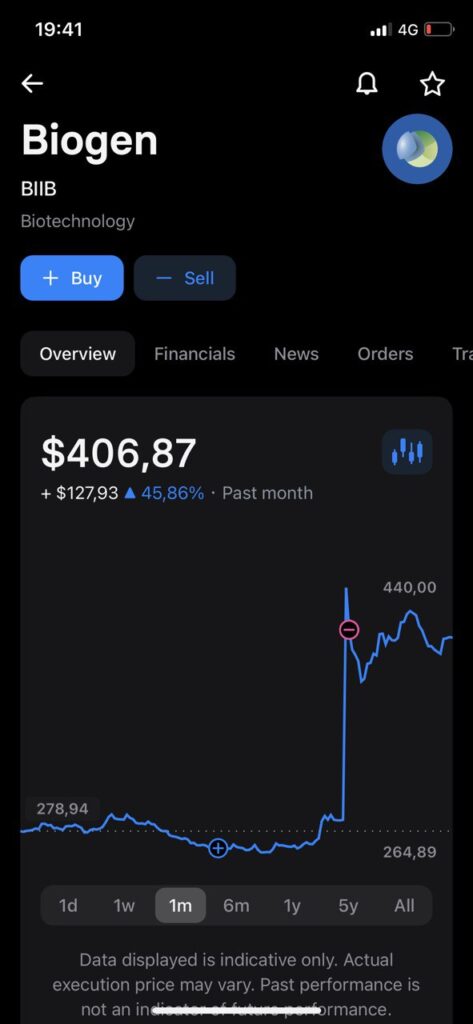

BIIB - Now 1/3 of the revenue comes from the Techfidera product, which is also patented in the USA until 2028, which guarantees a stable cash flow in the future. "Tekfidera" is used to treat multiple sclerosis. The company's arsenal includes many other drugs for hemophilia, for the treatment of chronic lymphocytic leukemia. Just a couple of days ago they licensed a drug against Alzheimer's! The world's first medicine! Hence the exponential rise in the share price.

PFE – Pfizer Inc. develops, manufactures, markets, distributes and sells biopharmaceutical products worldwide, offers drugs and vaccines in various therapeutic areas including cardiovascular metabolism and pain management under the brand names Eliquis, Chantix/Champix and Premarin. Pfizer makes cholesterol-lowering drugs, Lipitor, as well as Viagra, Lyrica, and other products.

He gave an example of those in which I invest myself. If you also set out to choose something suitable for yourself, then you should consider the following important factor:

Biotech volatility

If you follow me in Instagram, then you know about my favorite Biogen, whose stock jumps up and down by 30% depending on the news on their anti-Alzheimer drug (this is already in the past :), the drug was approved!). On June 7, the fate of their drug was decided and the price flew up. On the other hand, do not forget that in the event of subsequent difficulties in approving the drug, the shares may collapse by a good 34%, as it happened before, after statements that they will leave further drug trials.

Volatility is something you need to consider and invest in the short term or try to speculate hardly. Long-term investment in biotechnology will be your backbone against such volatile market movements. Plus, do not forget about gradual visits and an attempt to average the purchase price.

How to invest in the biotechnology sector?

Yes, volatility is something to live with in this sector. If you're satisfied, you can choose one or more companies from the list above, but by far the best option is to choose an Index Fund ETF that tracks the biotech sector. Thus, you will overcome volatility and provide more stable investment savings.

For example, one can choose a growth account in LHV and invest in a fund − Xtrackers MSCI World Health Care UCITS ETF 1C, which lists such companies as: Pfizer, Roche, Johnson & Johnson. At SEB Bank you can choose SEB Concept Biotechnology fund, which also monitors and makes active investment decisions based on analysis and selection primarily in companies in the biotech sector. Because US companies dominate the sector, most of the companies in which SEB invests are based in the US.

Or in the same SEB you can buy - iShares Nasdaq Biotechnology ETF (IBB). Like the previous recommendations, the index fund is focused on companies based in the US and operating specifically in the biotech sector. This is one of the largest funds, the maintenance fee is 0,47%.

Remarkably, for example, the NASDAQ Biotechnology ETF survived the 2008 crisis better than the S&P500 (red on the chart), DOW (blue) and Nasdaq 100 (orange). This generally indicates a weak correlation of the sector with the movement of the rest of the market and can also serve as a protective asset in case of strong volatility in other sectors.

leave a comment