When it comes to money, we're all looking for ways to make our investments less risky and more profitable. One important word comes to our aid in this: diversification. Difficult term? Let's understand it in simple words.

What is diversification?

Let's start with a definition to understand what we are talking about. Portfolio diversification is an investment strategy based on spreading investments among different types of assets in order to minimize risks and maximize potential returns.

Principle of operation

Let's look at a specific example to better understand how this works. Suppose you have an investment portfolio consisting entirely of shares of companies in the IT sector. If this sector faces difficulty, for example due to changes in legislation or economic factors, your entire portfolio could suffer serious losses.

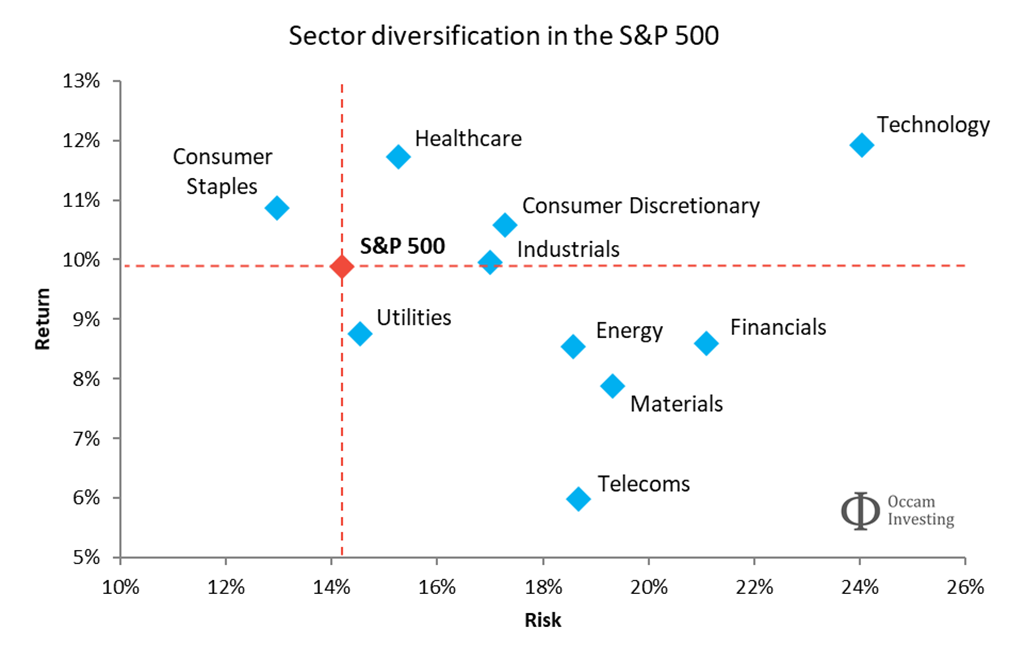

Now imagine diversifying your portfolio to include not only IT stocks, but also other industries such as healthcare, energy, and finance. If one industry struggles, others can continue to generate profits, softening the overall effect of losses.

Benefits of Diversification

So, what is the main point of diversification? The basic idea of diversification is that it reduces the risk associated with specific assets or industries, thereby avoiding becoming overly dependent on the success or failure of a particular type of investment. On the one hand, by buying assets from different industries, you increase the chance of facing the downside risk of certain assets in your portfolio, but you also increase the chance that other assets will be able to “save” your portfolio from a deep drawdown due to unforeseen events. As the saying goes: “Rescuing a sinking ship becomes more effective when we have as many diverse specialists on our team as possible, each with their own method of rescue. In this case, the likelihood of successfully getting out of trouble increases significantly.” The same thing happens in investments. When the market is generally down, a portfolio consisting of different companies, industries and assets has a better chance that at least one of them will bail us out from serious losses. That is, various economic or political events can greatly impact certain industries. This implies that diversification provides protection because not all assets are subject to the same risks. Thus, by including various assets in the portfolio, stable returns can be achieved. The future is unknown to us, and the chance that everything and everywhere will be bad at the same time is much less.

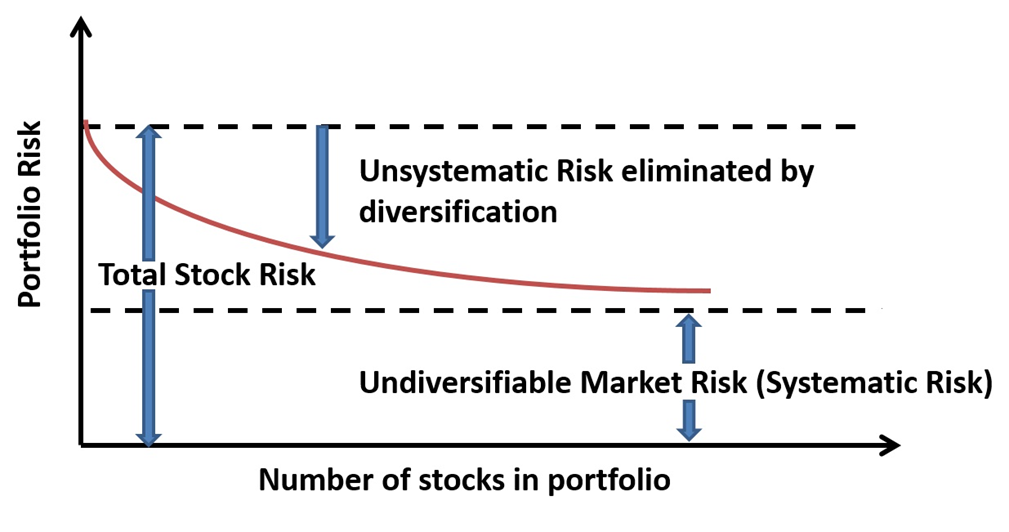

Unfortunately, we as investors are unable to control the returns or losses of our portfolio. However, we can influence the level of risk in our portfolio. Accordingly, the goal of diversification is to reduce downside risk, that is, to reduce the so-called “unsystematic risk” to a minimum, so that only “systematic risk” remains, which, unfortunately, cannot be avoided, since this is the risk to which all valuable assets are exposed. securities traded on the stock exchange. Unsystematic risk is the same risk that can be reduced precisely by diversifying the portfolio.

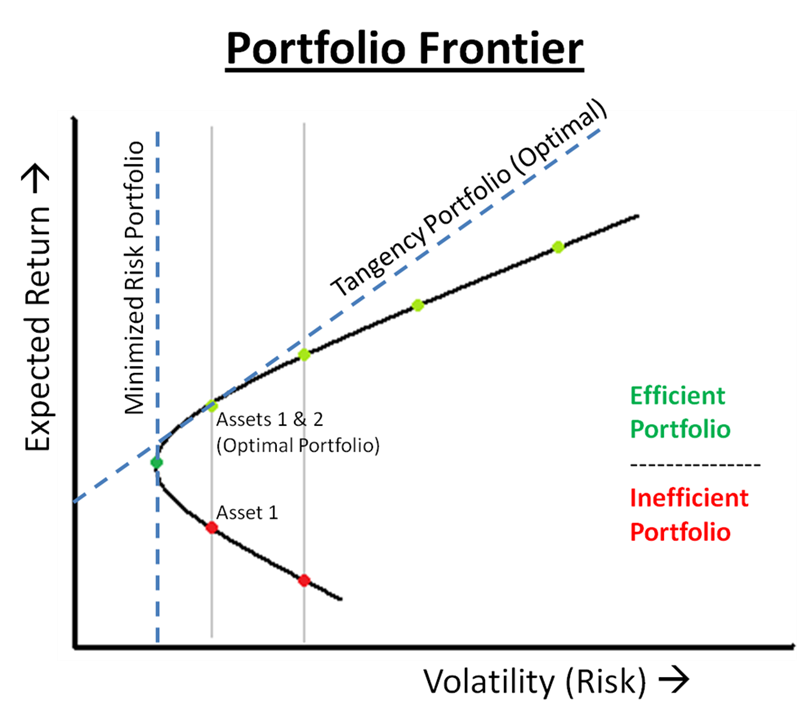

At the same time, you most likely will not lose in profitability, but will make your portfolio more stable by reducing risk. Let's return to the theory of the stock market, where the “Efficient Portfolio Curve” plays an important role. This chart suggests that diversification can provide the optimal mix of assets while minimizing overall risk. Spreading your assets so they don't move in the same direction smooths out fluctuations and reduces overall portfolio risk. The performance curve also demonstrates that through diversification it is possible to achieve the maximum expected return for a given level of risk. An investor can select the optimal portfolio on the curve depending on his or her risk tolerance level.

Ultimately, portfolio diversification brings peace of mind, making your decisions less emotional and more thoughtful. A broad and balanced portfolio eliminates the need to check your investment account daily to look for possible drawdowns.

Portfolio Diversification Strategies

So, after we have figured out what diversification is, why it is important and what it is needed for, a completely logical question arises: “How to do this? What portfolio diversification strategies are there and how to choose the right one? There is no clear answer to this question, as the effectiveness of the strategy depends on your overall investment approach, which becomes the basis for your diversification strategy.

1. Diversity of Assets

The main idea behind this strategy is that to build a stable portfolio, it is important not only to invest in stocks, but also to balance them with bonds and cash. Stocks provide the potential for growth, while bonds provide stable income, and cash provides liquidity during periods of uncertainty. For such a strategy, you can use the classic 40/60, where 40% of the portfolio will be in bonds, 60% in stocks, and cash will help during drawdowns in order to buy additional assets or buy new ones. Also, this formula can be modified depending on your risk tolerance, increasing the percentage of stocks in the portfolio for more aggressive investing, or vice versa, increasing the number of bonds for more conservative investing. The 40/60 strategy is more relevant now than ever, in such uncertain times. Also, such a portfolio can be diluted with different ETF funds (bonds can be purchased by an ETF fund), cryptocurrency, or alternative options for investment assets. Such a strategy can help to remain more stable during different economic cycles and will not allow the portfolio to sag significantly during a downturn in certain types of assets.

2. Industry Diversification

This method has been described previously, and the main idea is that the distribution of investments between different sectors of the economy leads to a more sustainable portfolio. Problems in one industry can be offset by successes in another, providing protection against industry-specific risks.

3. Geographical Diversity

The advantages of this strategy are that investing in different regions of the world mitigates the impact of local risks. Economic, political or currency risks can be minimized through a global approach. Different countries have completely different economies and in this way we can protect ourselves from macroeconomic and political risks when investing.

4. Capitalization of Companies

This strategy of investing in companies of various capitalizations helps balance risk and growth potential. Large companies provide stability; such companies grow slowly but steadily. Mid-cap companies have greater growth potential as they are in the process of growing their business and capturing market share. Small companies have a high risk, since they do not guarantee growth and have a small market share in conditions of close competition, however, such companies usually also have the opportunity for high income, since in the case of a successful business, growth can be quite rapid. That is, in this way you can invest 2-5% of your portfolio in companies with high growth potential. The chance of losing money is quite large, but if successful, the earnings can be so huge that they can pay off all the unsuccessful transactions.

5. Strategies Risk-Adjusted

This strategy can be classified as a more complex strategy, since it requires more professional knowledge, skills and tools for its implementation. This strategy is aimed at using financial instruments such as options or futures and protects the portfolio from market volatility. It should also be taken into account that options and futures have an expiration date, so this strategy is only suitable for those who are engaged in active portfolio management. If you want to understand derivatives in more detail, we have a webinar on this topic!

6. Diversification by Time

The idea of such a strategy is very simple, you just need to invest on an ongoing basis in small parts, which helps reduce the impact of temporary fluctuations and minimize the effect of buying at the market peak. In fact, this is called “averaging”, when an asset is not bought “here and now” in huge quantities, but this purchase is spread over a fairly long period of time, which helps improve the average price of the asset. For example, you can buy a certain amount of an asset every month, regardless of its price.

7. Balanced Investment Funds

In my opinion, this strategy is one of the simplest, since it requires absolutely no intervention in portfolio management. The strategy is aimed at purchasing funds that automatically maintain a certain ratio of stocks and bonds and reduces risk through diversification within the fund. All that remains for the investor is to buy funds, increasing the size of the portfolio.

8. Systematic Rebalancing

In this strategy, unlike the previous one, you act as a manager. If you manage your portfolio yourself, you will have to regularly review and adjust your portfolio. Systematic rebalancing takes time and attention, but such portfolio management is more rewarding because it allows you to maintain your desired portfolio structure, control risk and make more informed decisions about buying or selling assets, which will lead you to a clearer understanding of the market and the principle of investing.

9. Low Correlation Investments

The advantage of this strategy is that it is based on numerical indicators, which gives a more accurate picture of what is happening. The main idea is that you choose assets whose prices move independently of each other and have low correlation. This approach helps reduce the overall risk level of a portfolio because such assets can move in both the same and different directions, creating a more stable investment portfolio. However, it is worth considering that for such a strategy it is also necessary to take into account the weight of shares in the portfolio.

Summarizing…

Of course, choosing a specific diversification strategy will undoubtedly depend on your goals, investing style, risk tolerance, opportunities and available time. It is difficult to say which strategy is more effective, convenient and practical, since quite a lot depends on the market situation, investment time horizon, and preferred assets for investment. Also, each of the strategies can be combined and combined with each other to achieve better results. However, to find your “ideal” model for portfolio diversification, it’s worth trying to disassemble each one. By trying, combining and analyzing, you will eventually come to a more effective, convenient and interesting strategy for you, have no doubt about it.

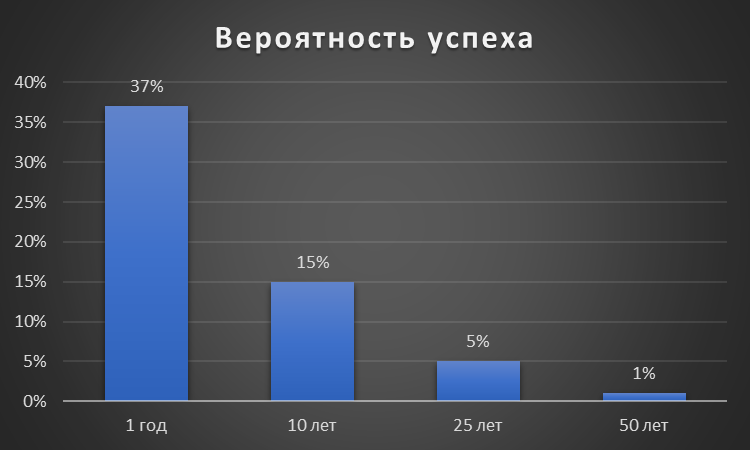

However, diversification is important, as many who are experienced in investing will tell you, because experience and research show that it is impossible to consistently beat the average return of the market, so it is better to protect yourself in such uncertain times. For example, Vanguard Group research shows the probability of success in overcoming returns is higher than the market average return among fund managers.

Therefore, diversification is important, since even professionals with active fund management have a hard time beating the average market returns over the long term, let alone the average actively trading investor. It’s difficult to beat the market, but it’s easy to lose money, so it’s still worth reducing risks for the sake of smaller losses when your portfolio draws down and in order to sleep a little more peacefully.

leave a comment