Investing in semiconductors, comparing NVIDIA and AMD

NVIDIA has recently dominated the world of artificial intelligence chip development, with its shares soaring 873% after announcing work in this area. However, the situation changed with the appearance of AMD on the scene, which presented its chips for working with artificial intelligence and caused serious competition. According to AMD, their chips are more efficient, and this is reflected in their shares, which have risen 195% since the announcement of the development. Since the trend for artificial intelligence is now the loudest and two strong competitors can be distinguished among the semiconductor sector, then let's take a more detailed look and analyze which of the two companies is more attractive from an investment point of view.

general review

AMD presents itself as a highly promising investment, especially in light of intense customer interest in alternatives to Nvidia GPUs. The decisions of major players such as Meta Platforms and Microsoft in favor of the AMD Instinct MI300X AI chip indicate a desire to diversify their choice and avoid complete dependence on Nvidia technologies. Based on the last three months, we can conclude that if AMD supports competitive alternatives, the company has the potential for further growth.

What sets AMD apart from Nvidia is that it provides a variety of chips instead of the latter's highly specialized GPUs. This diverse approach allows AMD to more effectively navigate potential challenges in the AI market, providing stability in the face of volatility.

While Nvidia's GPUs remain the standard in artificial intelligence and give the company market dominance, AMD is also gaining attention. Nvidia's investment in new chips maintains its technology leadership for now. While AMD will likely face challenges against Nvidia in the near term, its diverse approach could give it some staying power if challenges arise.

At the moment, AMD video cards demonstrate excellent gaming performance. In standard gaming scenarios, they are capable of outperforming Nvidia graphics cards by 25–35%. This trend may also have an impact on the artificial intelligence field in the long term, although there are no guarantees.

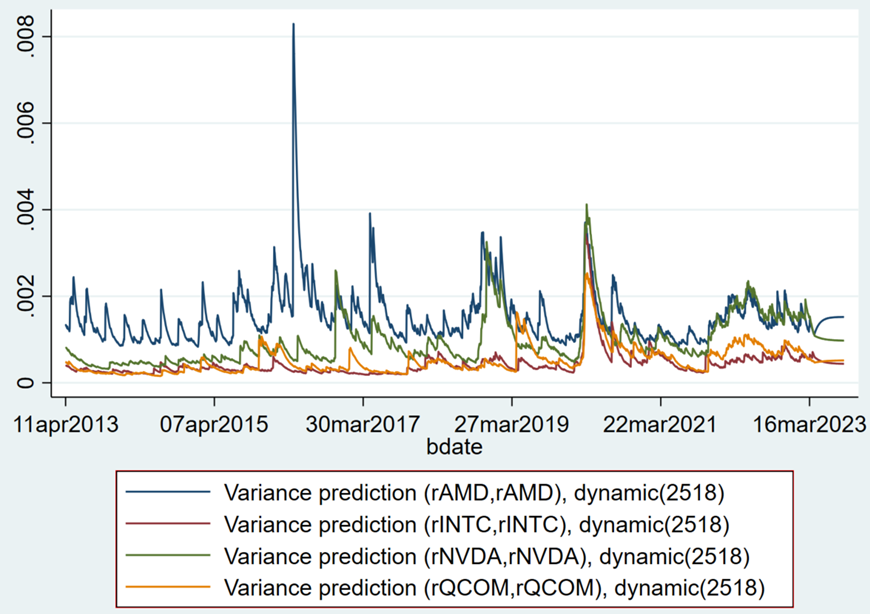

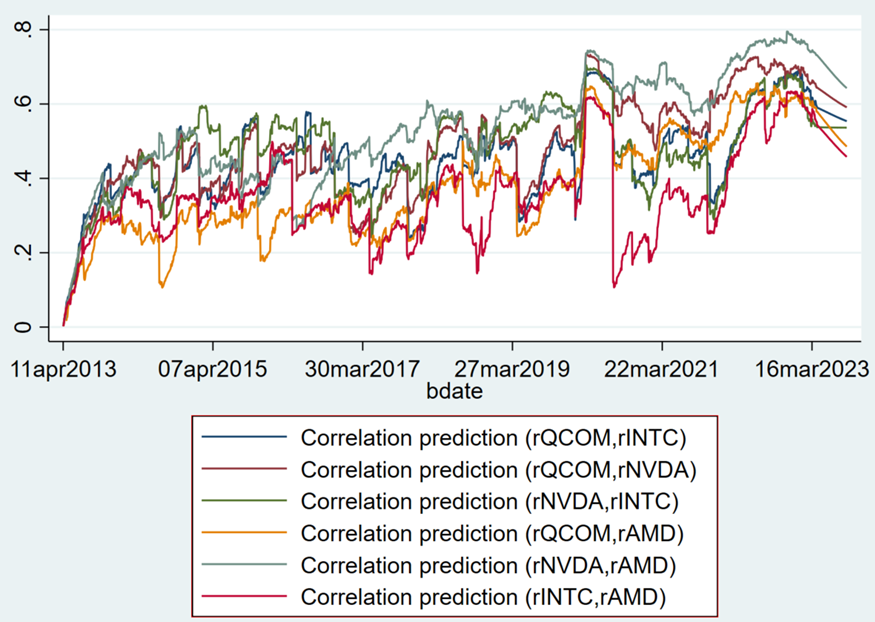

Volatility and correlation

Before jumping into the comparison between NVIDIA and AMD, we can take a look at the bigger picture and compare the volatility and correlation of the two companies' data among the major competitors in the semiconductor sector. Comparing volatility over time, we can conclude that historically, AMD had higher volatility, but recently, NVIDIA's volatility has risen to AMD's level and remains approximately 2 times higher than Intel and Qualcomm. That is, NVIDIA and AMD bear greater risk of volatility.

Taking a look at the dynamic correlation graph among companies, we can conclude that NVIDIA and AMD have a strong correlation that exceeds other companies. Intel, on the other hand, has the lowest correlation with all three companies, which could be a good choice if you want to diversify into the technology sector. However, despite the high correlation, this does not mean that NVIDIA and AMD are interchangeable stocks, as the correlation could be lowered depending on the companies' fundamentals and strategy going forward.

It's time to look at the numbers

Profit

If we analyze the companies' financial statements, it is striking that AMD incurs more significant expenses based on quarterly data, which entails a decrease in its quarterly profit. However, annual reports show that AMD has more frequent and consistent earnings growth compared to NVIDIA.

In the case of NVIDIA, it is noticeable that quarterly earnings increase more often, and this increase is more significant compared to AMD. However, it is also noted that NVIDIA experiences annual profit declines more frequently than AMD. It can be noted that AMD is experiencing less significant, but more stable growth. This phenomenon is quite understandable, given the company’s systematic investments in research and development, which exceed NVIDIA’s R&D costs by 4 times when adjusted for capitalization (3,26% for AMD versus 0,10% for NVIDIA).

AMD:

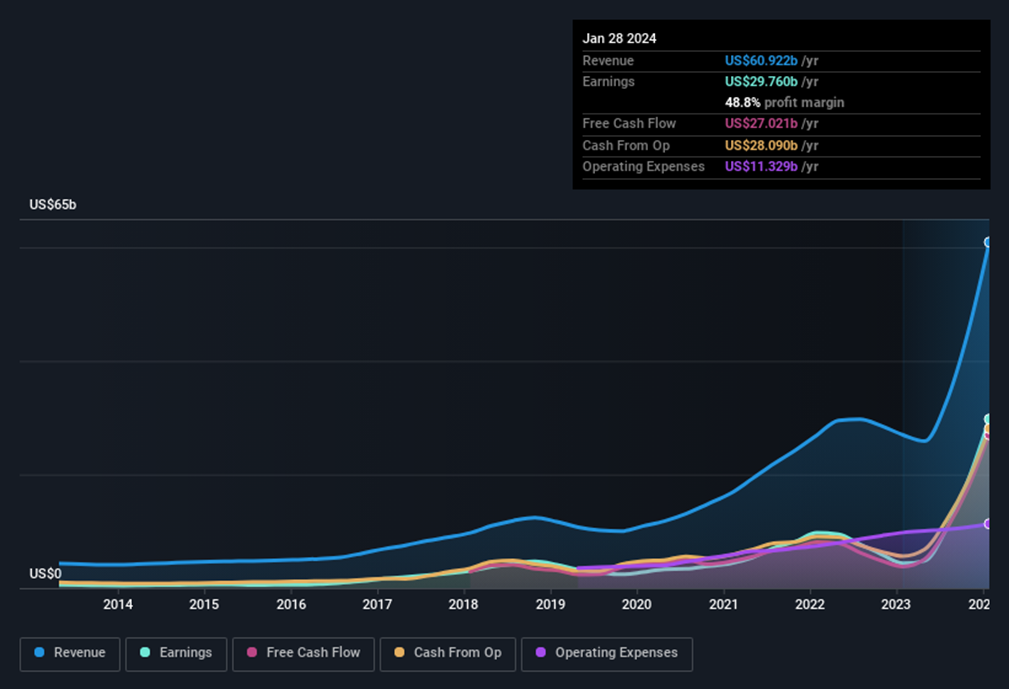

NVIDIA:

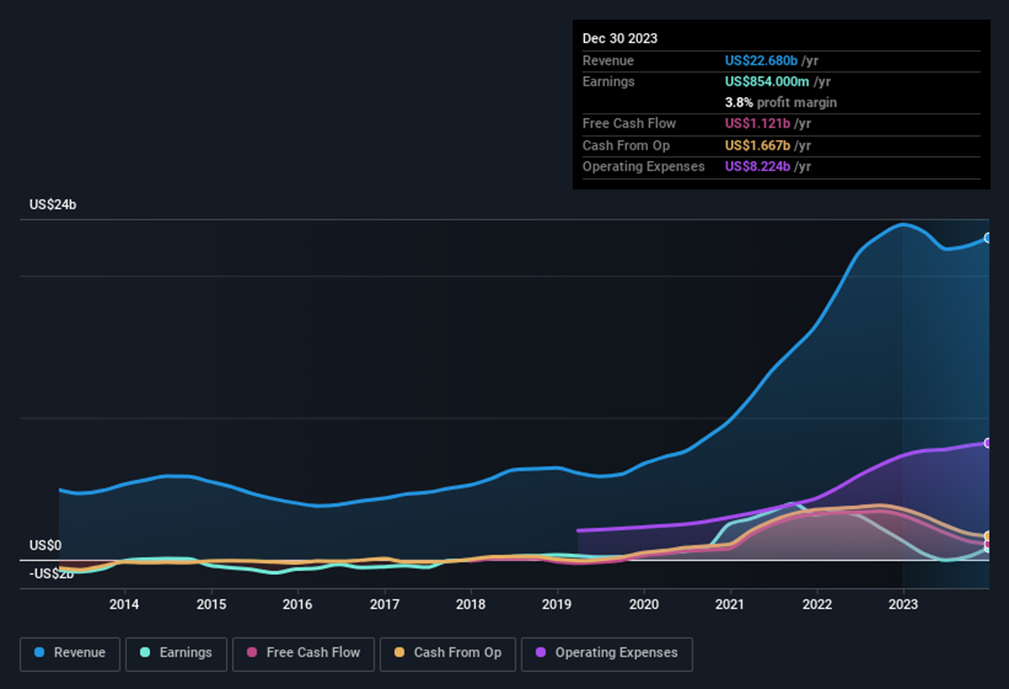

Sales and revenue

Opening the company's reporting, you can see that NVIDIA's sales exceed AMD's sales by approximately 3 times (60,92 billion for NVIDIA versus 22,68 billion for AMD), but you need to look at the dynamics. If we adjust for the company's capitalization, we can understand that relative to the company, AMD's sales are 2,5 times higher, which suggests that AMD is more efficient in terms of capital use compared to NVIDIA.

On average, AMD earns tens of times less than NVIDIA (0,854 billion for AMD versus 29,76 billion for NVIDIA), although at the same time, the number of sales of the companies does not lag far behind each other, no more than 3 times. It seems illogical, but this is explained by the fact that AMD sells hardware much cheaper than its competitor, as evidenced by the ROE and Profit Margin indicators.

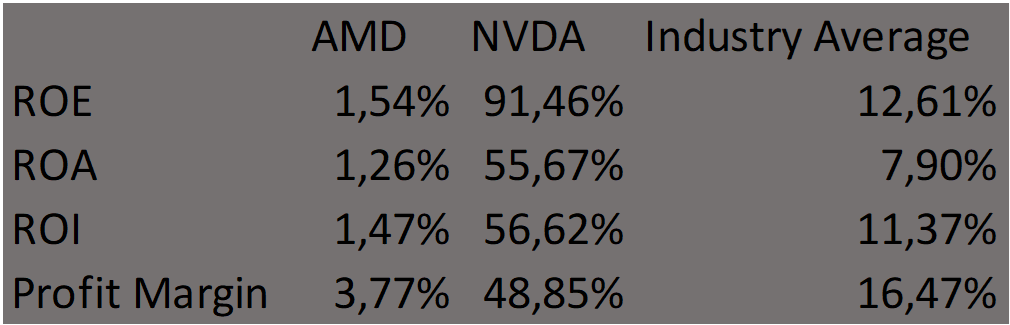

ROE (Return on Equity)

So, how well does the company manage its own capital to create profits? For AMD, this figure is only 1.54%, which is clearly not impressive, especially when compared to the industry average of 12.61%. While NVIDIA has an excellent ROE of 91.46%, which shows that the company is very adept at manipulating its capital to create value for its shareholders.

ROA (Return on Assets)

How well does the company use its assets to generate profit? AMD is also slightly behind here with an ROA of 1.26%, which is clearly below the industry average of 7.90%. While NVIDIA's ROA reaches 55.67%, which is several times higher than the industry average and indicates that the company invests its assets very efficiently.

ROI (return on investment)

Now let's look at the return on investment. AMD's rate is just 1.47%, which is below the industry average of 11.37%. While NVIDIA has an ROI of 56.62%, surpassing the industry average and AMD. However, if we take into account that NVIDIA is investing relatively less money, then such a high figure seems quite logical and should be taken with a grain of salt.

Profit Margin (Net profit from sales)

What about sales profitability? AMD's rate is 3.77%, again well below the industry average of 16.47%. NVIDIA's Profit Margin is 48.85%, which indicates a higher return on sales compared to AMD and the industry average.

As a result, according to all considered performance criteria (ROE, ROA, ROI, Profit Margin), NVIDIA demonstrates significantly higher performance compared to AMD and the industry average. These numbers highlight that NVIDIA is using its capital, assets and investments more efficiently and achieving higher sales profitability.

But it's not that simple, because if you look at the bigger picture and tie all the metrics together, you can come up with a theory that AMD is most likely choosing a longer-term play strategy. AMD is a small company relative to its competitor, and is trying to gain market share by offering a better product compared to NVIDIA at a lower price, which leads to lower profits and all indicators, since the company aims to improve its product for the sake of competitive advantage, so a large A portion of the company's total funds goes to research and development. NVIDIA, on the other hand, is aimed at making a profit right away, without placing a large bet on research and development, but also does not forget about improving its product.

Evaluation by criterion

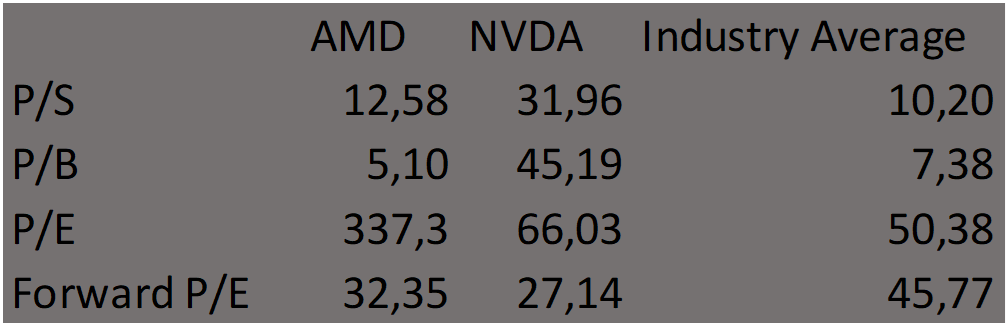

P/S (Price-to-Sales)

AMD's Price-to-Sales ratio is 12.58, which is higher than the industry average of 10.20, but lower than NVIDIA's 31.96, which indicates a more reasonable valuation for AMD, but is still very high. This may indicate high investor expectations for the company's future growth, perhaps related to promising products or technologies, as the market plays ahead and looks ahead.

P/E (Price-to-Earnings)

AMD's price-to-earnings ratio is 337.3, well above the industry average of 50.38 and NVIDIA's 66.03. This could indicate high investor expectations for AMD's future profitability, which could be driven by the growth prospects that investors are pricing in the company when looking at its Forward P/E. But even despite the Forward P/E such a large indicator, AMD is quite high.

Forward P/E (Forward Price-to-Earnings)

AMD's forward price-to-earnings ratio is 32.35, above the industry average of 45.77 and NVIDIA's forward price-to-earnings ratio of 27.14. A decrease in value compared to P/E may indicate that investors are more optimistic about AMD's future profitability.

Thus, investors also factor into the price the artificial intelligence trend in both companies, but they place a greater bet on AMD, which includes in the price both an increase in the number of sales and an increase in profits after the likely success, first of all, with hardware for working with artificial intelligence, and also for other products in their line. In the case of NVIDIA, expectations are more moderate, since the company has proven itself and shown its capabilities by releasing its own processors for working with artificial intelligence, so at the moment there are more expectations of an update in the product line, rather than the release of a completely new and innovative product.

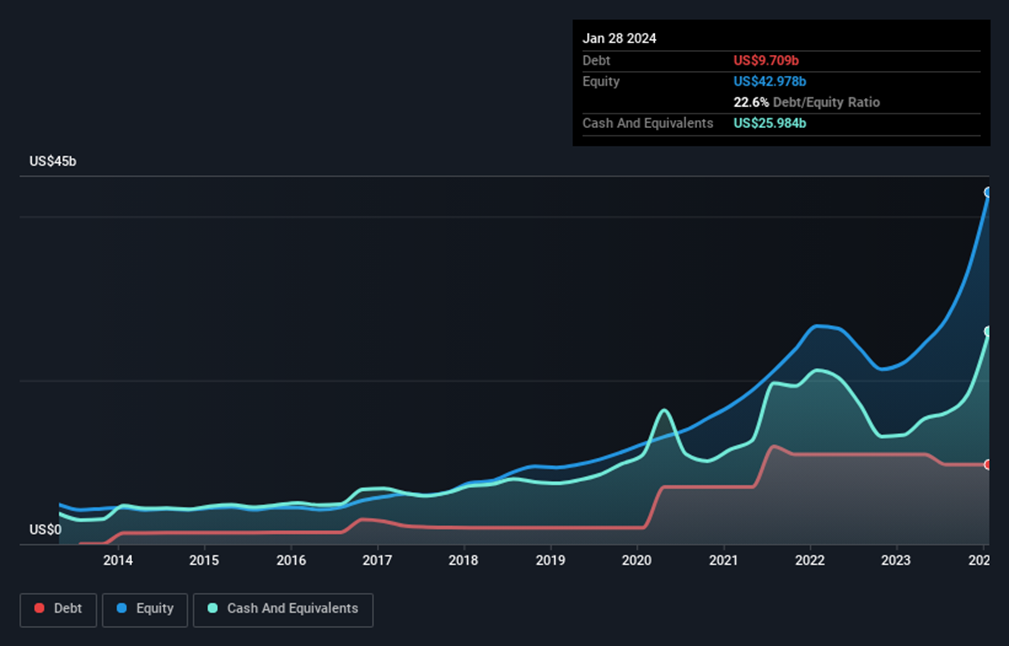

What about debts?

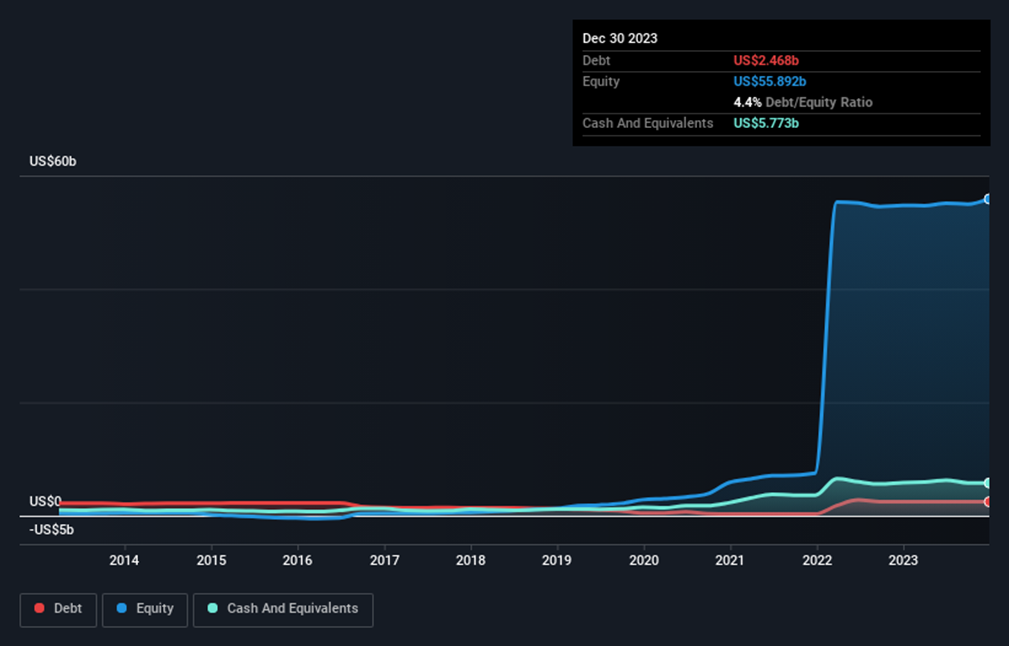

Both companies are doing well on a debt-to-equity ratio, as the companies' equity exceeds their debt. NVIDIA has been gradually increasing the level of borrowed funds with an increase in equity capital for a long time and can be said to play safer by adhering to a strategy where equity capital is 2 times higher than borrowed capital. AMD, on the other hand, is aimed at a more aggressive strategy and for a long period of time its borrowed capital remained at a ratio of 1 to 1, but in 2021, the company’s own funds increased sharply.

Thus, it can be noted that the NVIDIA company is developing steadily, however, if you go back and look at the company’s financial indicators and its profitability, we can assume that the company’s profit report is expected to increase, since the company is steadily growing and developing, and at the moment the trend is artificial intelligence is causing great demand for hardware among companies working on the development of AI. In the case of AMD, taking into account the strong increase in equity capital and the assumption of a more aggressive development strategy, it can be assumed that the company is expected to increase borrowed funds, which will be invested in development and research to capture greater market share in the artificial intelligence and semiconductor sectors , however, such an aggressive strategy carries greater risk of investing in a given company, since there is uncertainty of success.

AMD:

NVIDIA:

What is the conclusion?

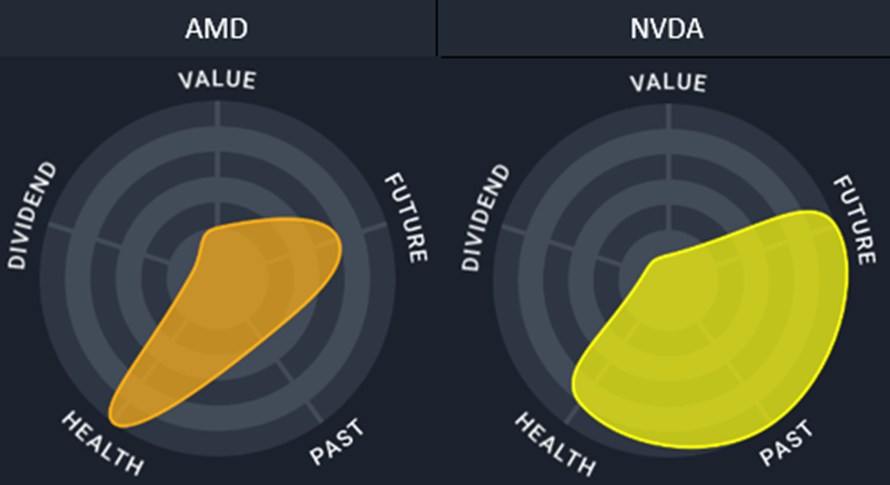

So, let's summarize. Based on the “snowflake”, one could conclude that NVIDIA is the clear winner here, but not everything is so simple.

AMD, despite lower quarterly profits and higher expenses, shows stable growth in annual profits. Its focus on research and development appears to be starting to pay off, making its products available at competitive prices, but some metrics are still far from ideal.

NVIDIA offers impressive quarterly profits, but its annual numbers are capricious. It is responding to current market demands by seeking instant success and is currently doing well, making it an attractive and safer choice.

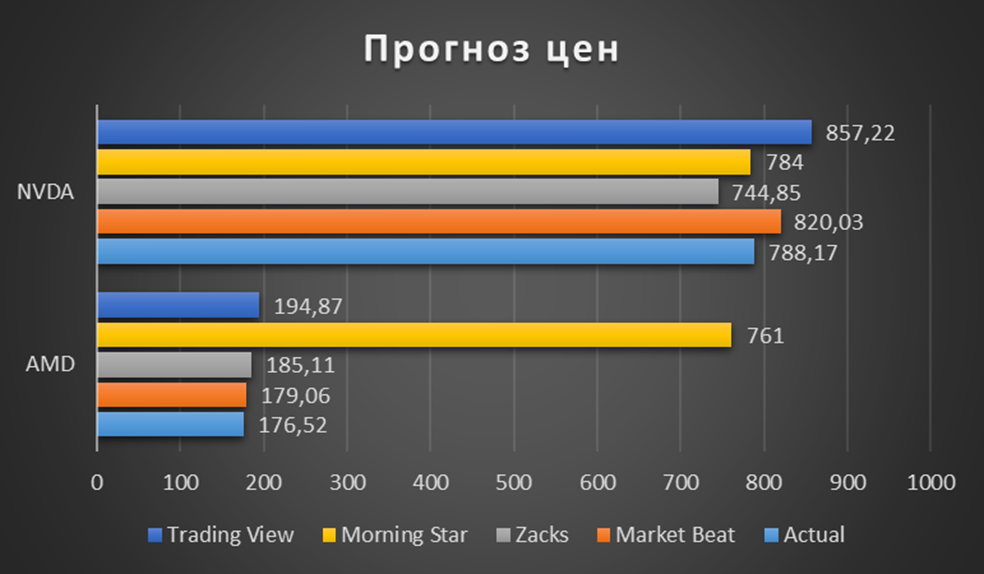

However, different analytical agencies give different forecasts regarding the prices of company shares, while analysts have much more faith in NVIDIA, however, this does not mean that AMD is an outsider.

Why might AMD be more interesting? Despite NVIDIA's superior current performance, AMD may be taking a longer-term strategy. It systematically invests heavily in research and development, pursuing more sustainable growth and competing for market share by offering quality products at lower prices. While NVIDIA, with a focus on profit in the moment, is guided by current market requirements and, perhaps, expects to update its product line.

In general, the choice between AMD and NVIDIA is a choice between long-term and short-term strategies. AMD is preparing for a marathon by investing in innovation. NVIDIA focuses on current trends. Investors are placing their bets on AMD's playbook and NVIDIA's brilliance. So, if you're looking for a more stable income and don't want to play the odds game, then NVIDIA might be a more attractive choice for you. If you're willing to take a risk and bet on the possibility of a strong earnings report followed by a sharp rise in the stock, then you might want to take a closer look at AMD.

It is difficult to say which of these companies is more attractive, since much depends on risk tolerance and investment strategy. Therefore, even in our group, views were divided regarding the choice of a more attractive company, which indicates the good development of two companies with different approaches to this development. However, it makes sense to take a closer look at this sector, since high demand for hardware for AI development will push the financial statements of such companies forward.

leave a comment