One evening, while browsing the news and enjoying a cup of tea, my eye fell on an article about Netflix and Disney+. The question arose: what do they offer their users, and how do they compare? Deciding to get into the details, I started doing my research in preparation for comparing these two popular streaming services.

In this article, I decided to compare specifically the streaming services of these two companies. Before delving into financial data, you need to understand the specifics of businesses and determine what their features and differences are.

At first sight…

The competition between Disney+ and Netflix is creating exciting dynamics in the streaming market. Navigating the world of entertainment, both companies have their own strengths and unique strategies that appeal to different audiences.

So let's take a closer look at their differences and what they could mean for investors. Let's start with geography. Netflix, which launched earlier, extends to more than 190 countries, offering its wide catalog of content. On the other hand, Disney+ is limited to only 60 countries. This means that Netflix has more options for global audiences, while Disney+ focuses on specific regions.

An important aspect is the amount of content and subscribers. Netflix has the advantage of providing over 17 content titles and 000 million subscribers worldwide. On the other hand, Disney+ offers more than 238,39 TV series episodes and 15 movies, and has more than 000 million subscribers. However, it is worth remembering that Disney+ is actively expanding its catalog and audience.

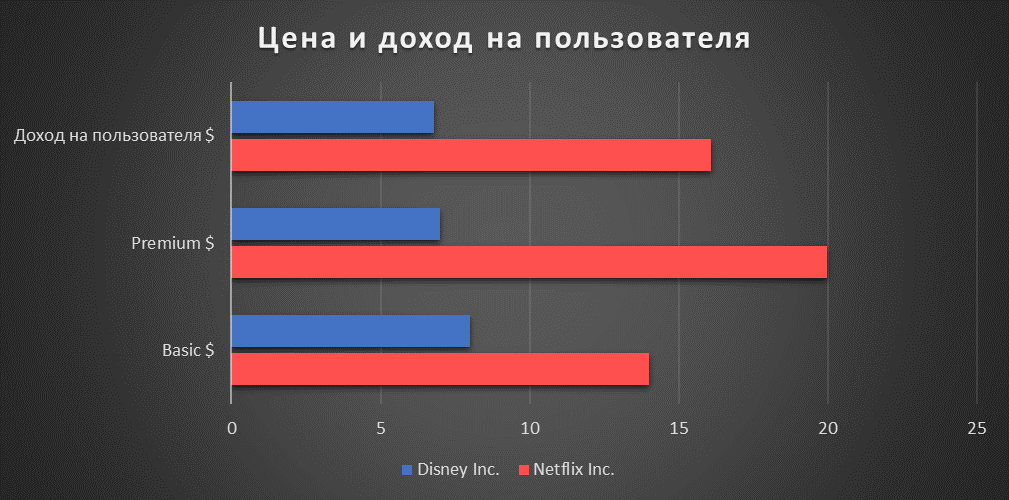

Let's move on to pricing and how it affects the choice between Disney+ and Netflix. Disney+ offers two simple plans: Basic for $7,99 per month with ads and Premium for $10,99 per month without ads. Premium recently increased its price to $13,99 per month. Compared to Netflix, the latter has a more affordable ad-supported plan for $6,99 per month and a premium plan for $19,99 per month, also ad-free.

So, what conclusions can we draw? The Netflix ad-supported plan is more affordable than the ad-supported Disney+ plan. However, Disney+'s premium plan ends up being more affordable than Netflix's equivalent plan. The choice depends on your preferences and budget.

When we look at average revenue per user (ARPU), we see that Disney+ has an ARPU of $6,80 in the US through Q2023 0,64 and $16,09 for Disney+ Hotstar. Comparatively, Netflix's ARPU is higher at around $7,84 in the US and $XNUMX in Asia Pacific. This may indicate that Netflix users are willing to pay more for streaming services than Disney+ users.

Both services generate decent revenue, but Netflix looks more stable here. Disney+ has an operating loss, which could raise questions about Disney+'s long-term sustainability, while Netflix is turning a profit.

Time to look under the hood and take a closer look

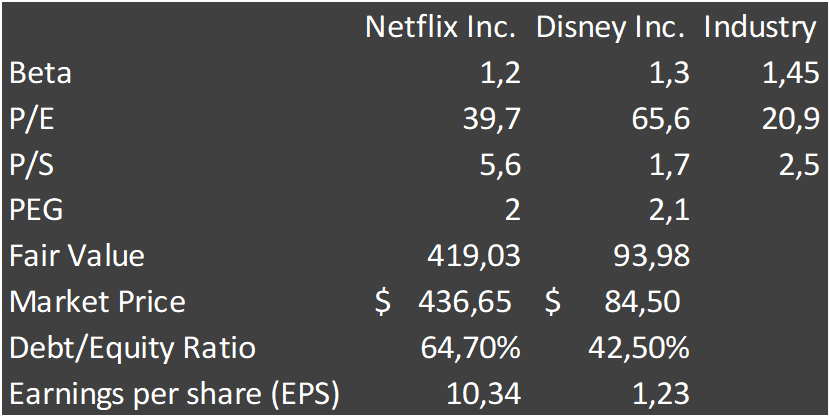

Netflix's (NFLX) current stock price is $448.65, trading above its fair value estimate of $418.15, which could be attractive to investors. Disney (DIS) shares are trading below fair value estimates at $91,07 ($93.82).

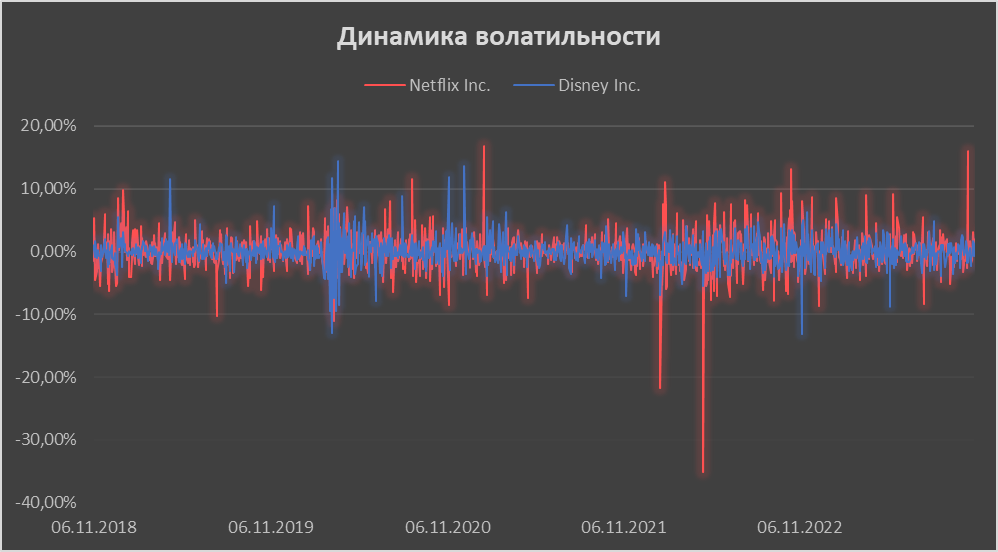

At first glance, it would seem that the choice is obvious, since Disney Inc. shares. have not shown growth for quite a long time, and Netflix Inc. shares. have good potential, since they have recently shown growth after a strong correction, but if you look at the volatility, you can doubt the choice, since the volatility of Netflix Inc. much higher.

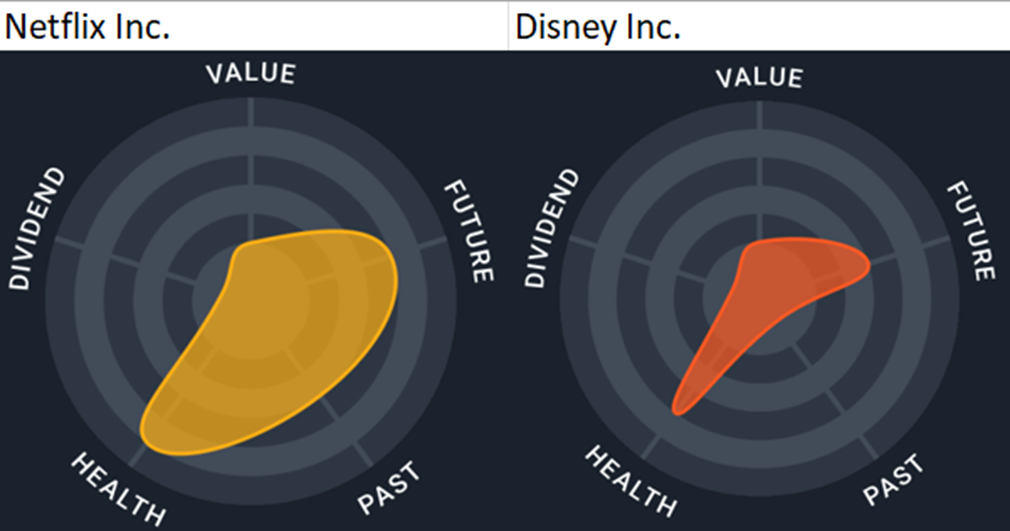

Let's look at the "snowflake" of companies that visually show the "health of the company."

Well, now the picture seems obvious as it may seem, but it is necessary to understand why these “snowflakes” are so different and what evaluation criteria led to the conclusion of such estimates. It is possible that some of these estimates are not so important and significant, while others, on the contrary, can greatly affect the long term.

- Evaluation by criterion

P/E (Price-to-Earnings Ratio):

This is exactly the tool that will help you understand how much investors believe in the future success of companies. Netflix has a P/E of 39,7, while Disney's P/E of 65,6 is well above the industry average of 20,9, although Disney has other businesses as well. Both streaming giants have high P/Es, indicating high expectations for future earnings growth. However, Netflix holds a slight lead in this game, which could indicate a more reasonable valuation for its stock.

P/S (Price-to-Sales Ratio):

The P/S reflects the stock's valuation relative to the company's earnings. Netflix has a P/S of 5,6, while Disney's P/S is 1,7. This could indicate higher investor expectations for Netflix's revenue. There is less faith in Disney in this regard, since its value is below the industry average (2,5). Also, in the case of Disney, based on this indicator, we can say that the stock price is undervalued, and in the case of Netflix, it is overvalued by more than 2 times relative to the industry.

PEG (Price/Earnings-to-Growth Ratio):

PEG will help us evaluate a stock relative to expected growth. Both Netflix and Disney have PEGs just above 2, indicating high investor expectations for future growth. On this battlefield, both giants are kept at approximately the same level.

Profitability and forecasts:

When it comes to net profit (Net Profit Margin), use of equity capital, assets and investments (Return on Equity, Return on Assets, Return on Investments), the scenario becomes more complicated. Why? Because Disney Inc. — these are not only streaming services, these are also amusement parks and other areas. And this complicates analysis by these criteria, since their assessment may be skewed by the diversity of Disney's business.

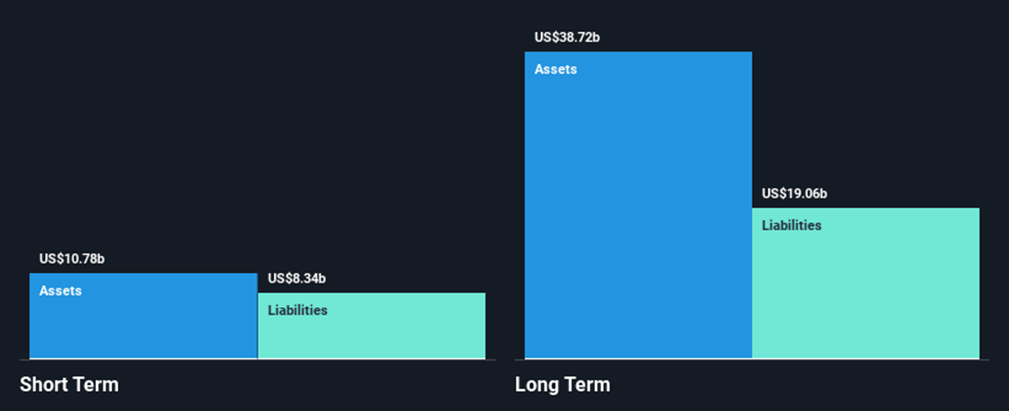

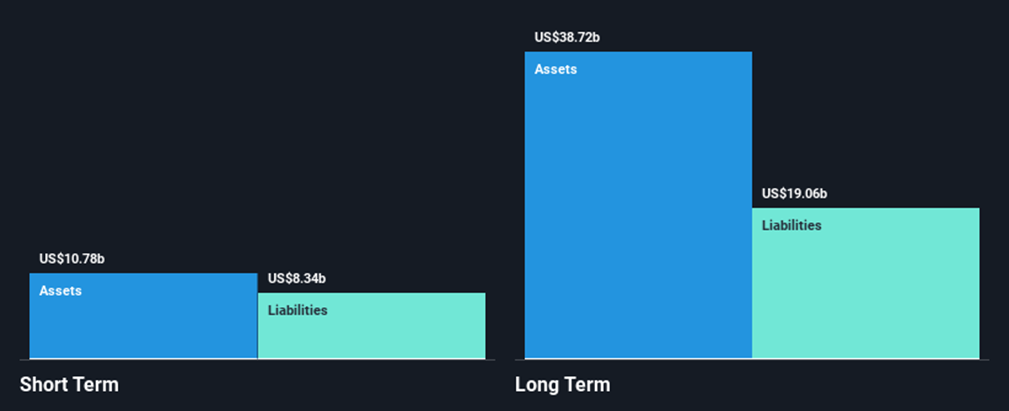

- Structure of short-term and long-term liabilities:

Netflix has short-term assets ($10.8 billion) in excess of current short-term liabilities ($8.3 billion).

Disney+ also has short-term assets ($30.2 billion) that exceed its current short-term liabilities ($28.2 billion).

However, Netflix doesn't have enough short-term assets to cover its long-term liabilities, while Disney+ has a more significant problem.

Given that both streaming services have debt, their ability to cover it with their own funds is important for investors.

Netflix:

Disney:

- Dividends:

Investors looking for stable income may be disappointed - neither Netflix nor Disney pay more dividends, since they are representatives of "growth" companies and their main goal is to grow aggressively, directing all funds to the development of the company. Disney paid dividends until 2020, but due to the impact of covid, it stopped and has not resumed regular payments since then.

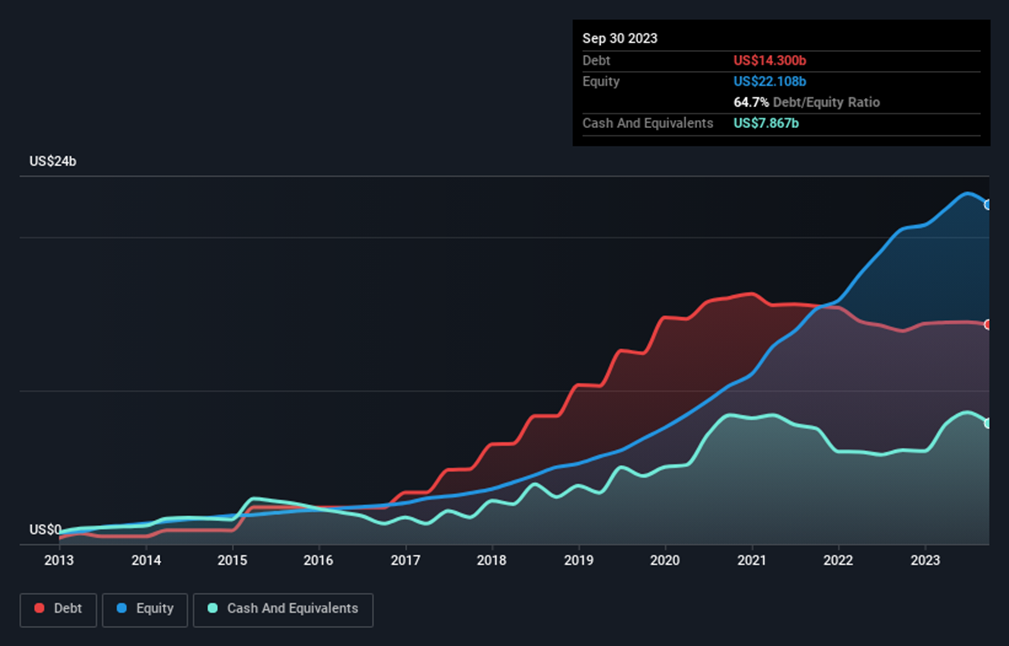

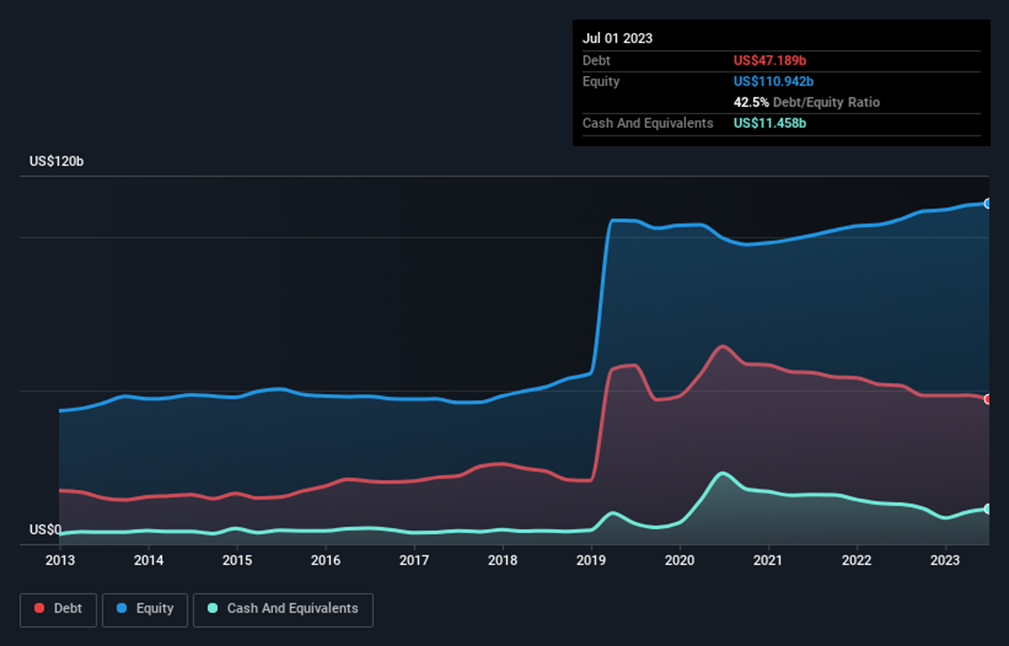

- Financial stability:

And finally, how do both giants manage their financial obligations? Disney is better at covering its debt with its own funds compared to Netflix, since the former company's liabilities are only 42,5% of the company's equity, in the case of the latter company, this figure is higher, at 64,7%. Also, you can see that Netflix is not afraid to take risks and greater leverage, since in previous periods their debt load exceeded their own funds, which influenced the rapid growth of the company. In the case of Disney, we can say that the company does not like to take big risks and tends to grow slowly but surely and capture market share. For a company like Disney, it's a higher priority to stay on its feet than to grow quickly and rapidly like Netflix.

Netflix:

Disney:

So, let's summarize...

When you're faced with a choice between investing in Netflix or Disney, there are a few key factors that can help you make your decision.

Netflix is profitable due to its financial strength. The company has a strong financial base, making it less susceptible to economic fluctuations. Netflix also has good profitability, which suggests it is successfully turning its revenue into profit. However, Netflix's share price may be high relative to earnings (P/E ratio), which could make it overvalued, which poses a risk to investors.

Disney, on the other hand, has ambitious growth plans. The company is developing its streaming platforms and expanding into new segments of the entertainment market, such as theme parks and gift shops. However, Disney's profitability has declined, which may cause concern among investors. In addition, the company faces debt management, which requires additional efforts.

Therefore, your choice will depend on your investment goals and risk tolerance. If you prefer a more stable and conservative investment, then Disney may be a suitable option as it is slowly but surely growing and growing, investing heavily in development and research, primarily focusing on theme parks and investing in their development, but also into entertainment content. It is worth noting that the leading driver of income for Disney is streaming services at the moment, accounting for the majority of its income. By betting on theme parks, the company is looking towards business diversification, which could be a good opportunity to reduce risks. However, if you are willing to take risks and are looking for a company with ambitious growth prospects, then Netflix may be a better choice as the company is not afraid to take on high risks in order to grow faster and develop in its own industry, but the shares of such a company may fluctuate more and show both stronger growth and stronger decline in a shorter period of time. It may also be appropriate for you to offset your risk by holding both of these companies in your portfolio, so you cover part of the industry and don't put all your eggs in one basket. It's also important to consider your investment horizon and financial goals to make an informed choice between these two entertainment giants.

leave a comment