Some time ago we analyzed the Growth Account from LHV, let's analyze the 3rd pension pillar. Once upon a time, there was no 3rd pillar at all”sexual“, and was not the best investment product, but everything has changed! In fact, everything is much simpler here and there are not so many options to choose from - Index fund, it was he who made this product more attractive.

What makes the 3 pillar pension so popular? And the fact that this is the only investment product that has received strong government support, in the form of tax relief!

What does this mean? This means that when you file a declaration, you get back the income tax paid upon receipt of your salary from the invested money, and this, for a second, is 20%.

Sounds cool, but not everything is so simple, there are some limitations! You can only invest the amount exceeding 15% of the annual gross income and not more than 6000 eur. The calculation is carried out according to calendar year. On January 1, a new period began and it is no longer possible to retroactively contribute money to the 3rd pension pillar in order to receive a tax refund this year 2022. Starting from today, the amounts can be declared only in 2023 (I apologize for earlier that the article was not published earlier).

I do not recommend investing in the 3rd pillar more than it should, because you will not receive your income tax back from the excess amount, and when selling, the tax will need to be paid on the amount from which the state did not return the tax. And it turns out such an unpleasant situation when you have to pay double income tax on the extra amount.

Let's take an example: You have the opportunity to get income tax back from 6000 eur (15% of your annual income). But let's say you have deposited more into your pension account, and this amount is equal to 7000 eur. In such a situation, you will get 6000% back from 20 eur, but not from the remaining 1000 eur. Why is that bad? Because, when selling parts of the fund, you need to pay income tax on the entire amount, both from 6000 for which you received a tax refund and from 1000 for which you did not.

The golden rule of investing in the 3 pillar - do not pay income tax on your income, then you have nothing to return - in other words, you have there is no way to return 20% back! In this case, LHV Growth Account or Robur Swedbank remains the best option for you. This most often applies to children - no official salary entrepreneurs - who pay themselves only dividends (income tax is paid by the company, not by an individual), and with minimum wage – who have no income tax, and so on.

Unlike stage 2, in stage 3 the investor must transfer money himself. It doesn’t matter how often you do it and for what amounts, the main thing is that you don’t invest more than you should. You can find out the employer's ability to immediately transfer part of the amount to the 3rd pillar, in which case the investment amount will be from the gross salary. Some companies encourage and help their employees to invest (check your incentive package).

A little advice from us – choose index fund (LHV, Swedbank and Tuleva have them), as well as diversify with time and invest regularly. Regular investment reduce the risk invest at the wrong time, namely before a market correction. And it’s also psychologically easier, try to transfer a couple of thousand euros at the end of the year.

And again, save your nerves! Make a payment order once a week, once a month, once a quarter, fulfilling all the conditions and not exceeding the investment limits, and forget about the existence of this pension fundbut don't forget reinvest income tax refund!

“There are no restrictions on making payments from the third pillar: you have the right to withdraw the amount of savings you need at any time. To do this, you must apply for a payment or enter into a fixed-term or lifetime pension contract.” The tax rate depends on the terms of payments, and I decided to simply provide you with a screenshot of these terms. pensionikeskus:

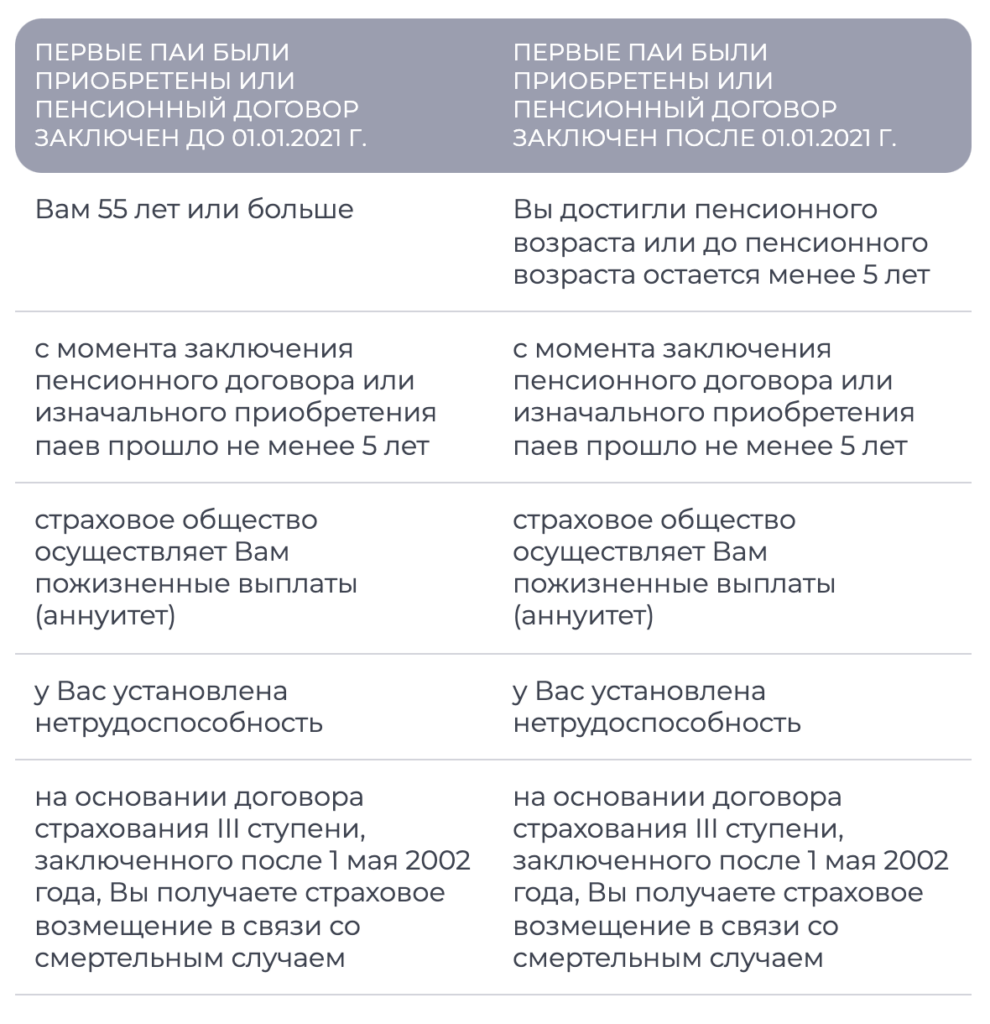

The tax exemption applies if

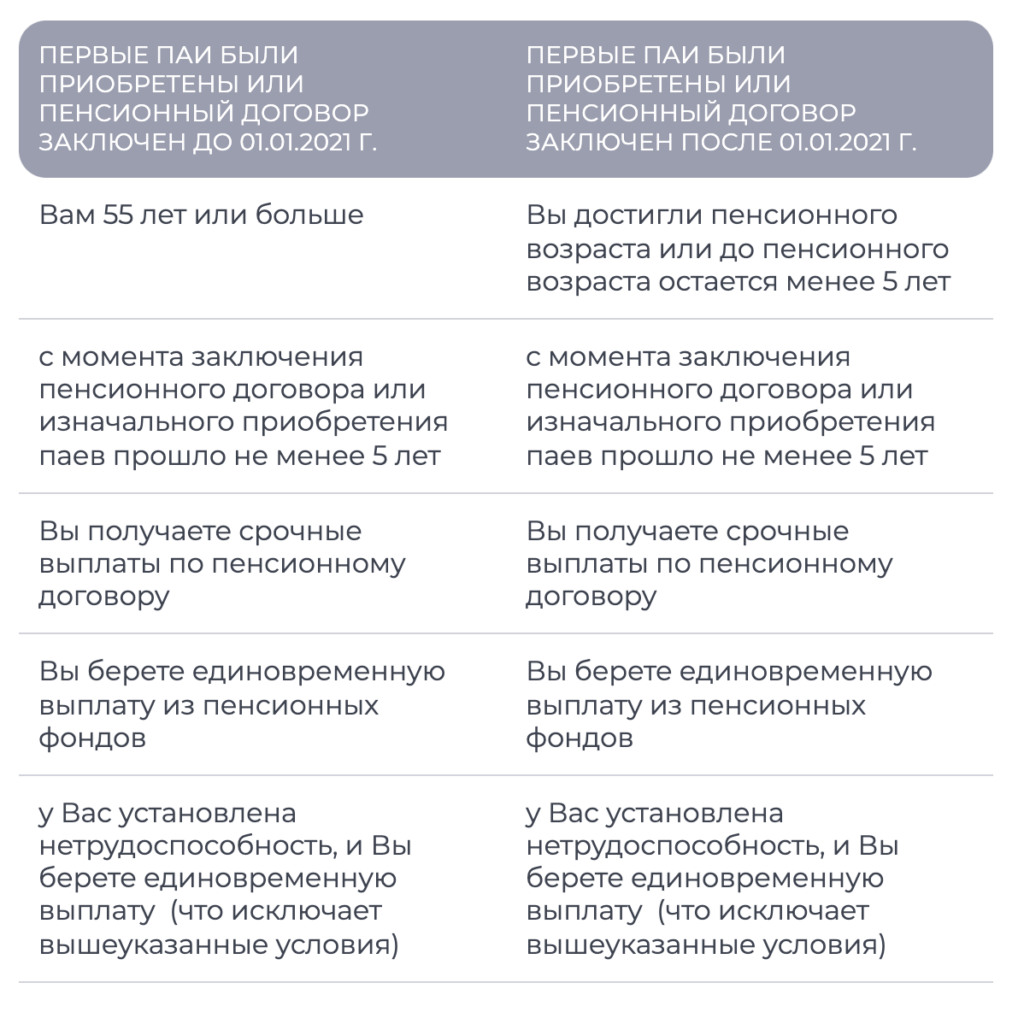

A tax credit of 10% applies if

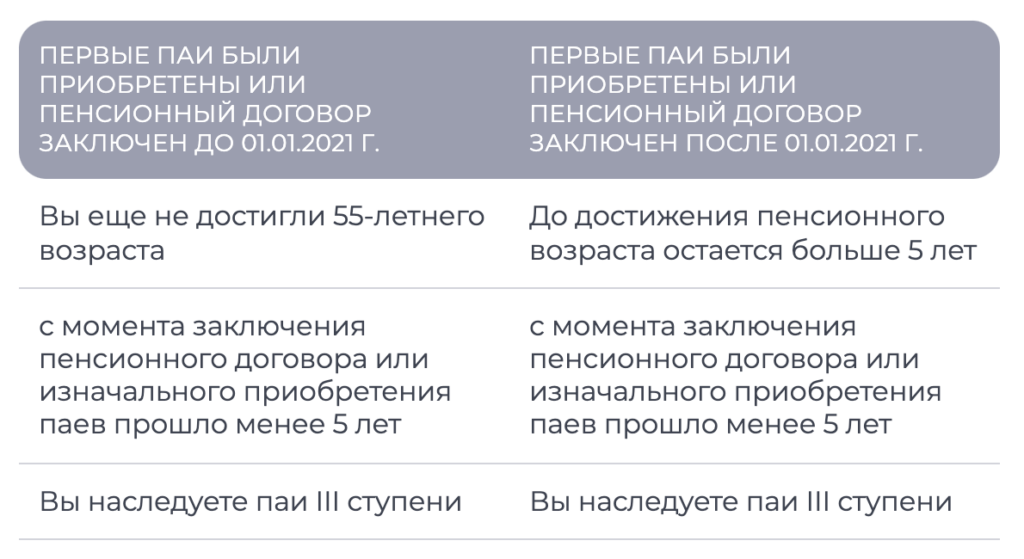

An income tax of 20% applies if

leave a comment