I wrote earlier in a previous article that financial markets have become detached from reality and have forgotten about fundamental indicators. The only question was when the markets would have to admit that COVID had a vast impact on the economies of all countries and the only question was the appearance of a black swan, which in my opinion happened on 24/02/2022.

Let's not go into politics, let's figure out what's going on in Russia first of all, and then look at the prospects for Europe.

The ruble exchange rate and the list of companies that exit the Russian market.

As you can see, lately Russia has been more interested in geopolitics than economic issues and maintaining the ruble exchange rate against other foreign currencies, which in fact caused such a dramatic depreciation over the past 20 years.

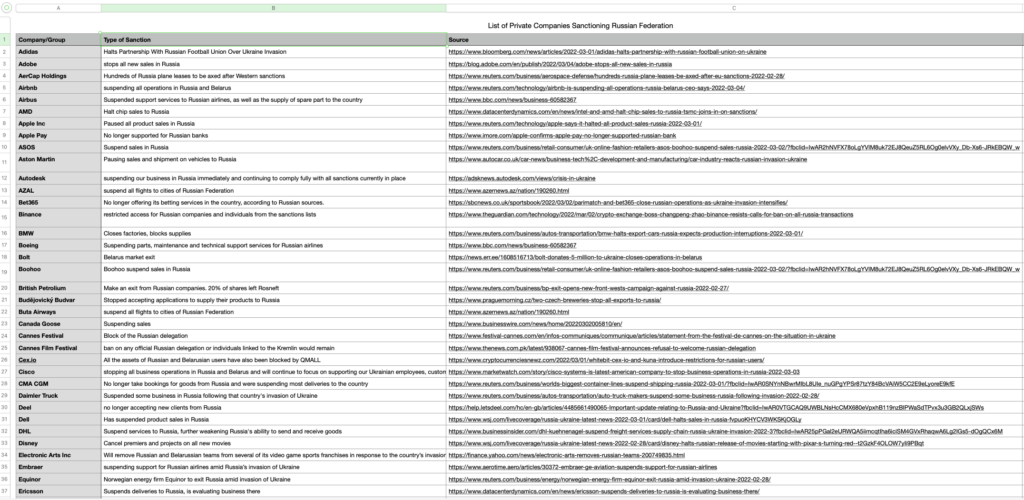

The fall in the exchange rate, of course, is half the trouble, the list of companies that have now limited or completely refused to work in Russia due to the “military operation” in Ukraine looks much more frightening.

In order not to lose it, I also provide it in .csv format at the link here.

The list contains, at the time of writing, 127 companies, large corporations, which have arranged an economic Iron Curtain for Russia.

In the list you will find many manufacturers of cars and spare parts (General Motors, Harley Davidson, Honda, Volvo, BMW, Mercedes, Nissan). The oil companies BP and Shell have already made relevant statements that they are withdrawing from investment projects in which they have participated for decades. Equinor, Norway's largest energy company, has stopped making new investments in Russia and has begun the process of exiting existing ones. This tangle will begin to unwind further, it has just begun to unravel.

Gold and foreign exchange reserves under a big blow

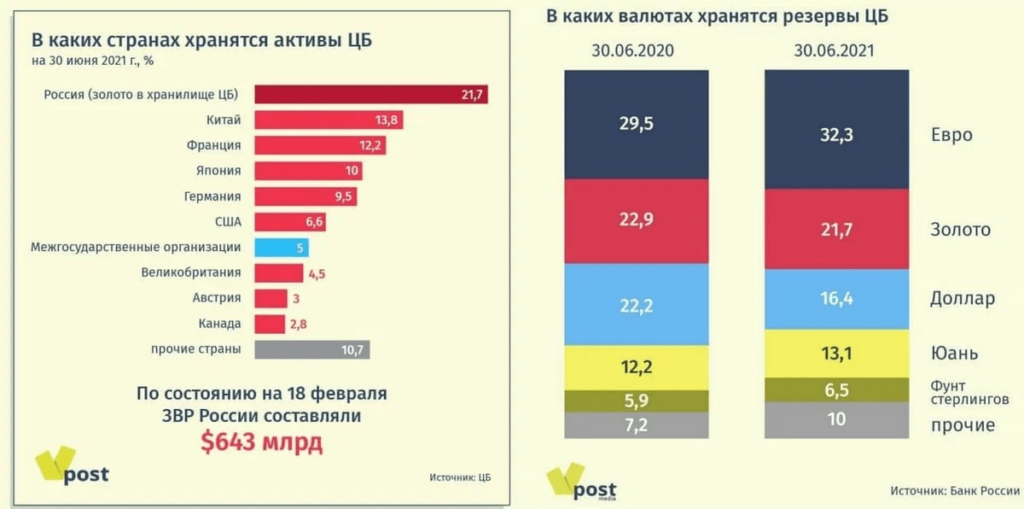

The assets of the central bank of Russia were kept in the accounts of various countries. France, Japan, Germany, the USA, Great Britain, Canada have announced that they will freeze foreign exchange reserves, which means that Russia may lose about 48% of its assets.

This means that the Central Bank has lost one of the levers, if possible, to protect the national currency from falling. Instead, a temporary protective measure was introduced on the purchase of foreign currency in the form of 30%, and then a reduction to 12% tax on the purchase. The Central Bank rate was also raised to a record 20%, let's see how strong support this is, while it barely helps the ruble to recover.

Oil that no one needs anymore

The exchange rate of the ruble, the list of companies exiting the Russian market, frozen reserves, limiting tools to support the economy is half the trouble. No one needs the main tool for maintaining the course and economic progress!

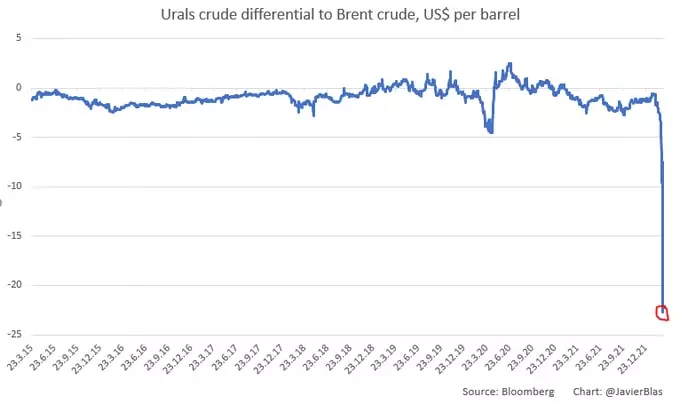

The Russian grade Urals is the main one for oil refineries in North-West Europe and the Mediterranean, S&P Global Platts notes. Among other traditionally large buyers of Russian oil are Germany, Italy, the Netherlands, Poland, Finland, Lithuania, Greece, Romania, Turkey and Bulgaria, let's take a look at the chart of what is happening with Ural oil now.

Urals oil is greatly reduced in price, in relation to Brent, the discount is currently minus $22,7. An embargo has been imposed on Russian oil, Europe has stopped buying one of the country's most important strategic resources.

Oil has always played and continues to play an extremely important role in the development of the world economy and international trade. Russia, which owns extremely large oil reserves and a developed oil industry, has traditionally been one of the largest exporters of this raw material to the world market. At the same time, the oil industry is the most important component of the socio-economic development of Russia with all the variety of ties with other industries and sectors of the economy. A significant share of the revenue side of the Russian budget comes from oil exports. What will happen to the budget when there is a hole in it in the line of oil exports? And this hole in 2020 was estimated at 4% of the country's total GDP. Link here.

Flight with terminal station “Default”.

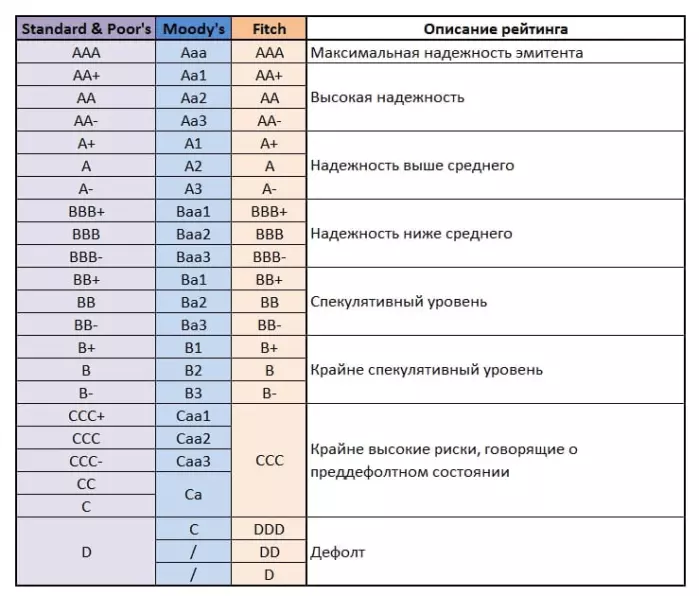

Rating agencies Fitch, Moody, Standard & Poor's downgraded Russia's rating by 6 (!) notches at once - from BBB (investment grade) to B, CCC (garbage!). For understanding, this is the rating of Libya, Mongolia, Nigeria, and slightly lower than the rating of Papua New Guinea (B+).

A credit rating is the rating agency's opinion of a borrower's overall creditworthiness or a borrower's creditworthiness for specific debt obligations, based on an assessment of risk factors. Credit ratings are calculated on the basis of the past and current financial history of the above market participants, as well as on the basis of estimates of the size of their property and financial obligations (debts) assumed. The main purpose of such assessments is to give potential creditors / savers an idea of the likelihood of timely payment of financial obligations taken on.

The internal charters of investment funds say that if the rating is downgraded to non-investment, the securities of this issuer must be abandoned when investing, which means that Russian stock quotes will face further free fall, an outflow of investment capital and complete isolation of the country. Analysts say - “Get ready for the default of the country”! And the funds and their managers simply do not have any choice.

The functioning of the stock market

There have never been such large-scale sanctions in the history of modern Russia, but we can give an example of Iran, which also faced serious sanctions pressure in the 21st century. In total, from 2010 to 2014, when restrictive measures were introduced (including the shutdown of SWIFT), the TEDPIX stock index quadrupled. Prices in the country for the same period - 2,4 times. Thus, in real terms, the return on the national stock market was 13-14% annually. The Tehran Stock Exchange, the largest in the country, is in the world's top 20 in terms of capitalization. Hundreds of companies continue to trade on it.

In general, if we talk about financial markets, they are quite tenacious for the reason that they help the economy. Among the top 20 countries by GDP, there is not a single one in which there would be no financial market. It is extremely unlikely that there will be no market left in Russia, but it may transform or freeze for some indefinite period.

Implications for the European Region

Unfortunately, Russia's problems are not only its problems, but also the problems of the entire European region. Companies have briskly abandoned one of the largest sales markets and this will hit economically from different directions:

- Energy crisis. Rising gas and electricity prices

- Job loss and unemployment

- Inflation and stagflation will continue to gain momentum

- Shortage of precious metals and raw materials.

- Collapse of delivery times and increased transport costs in all sectors of the economy

Energy crisis. Will we freeze this spring?

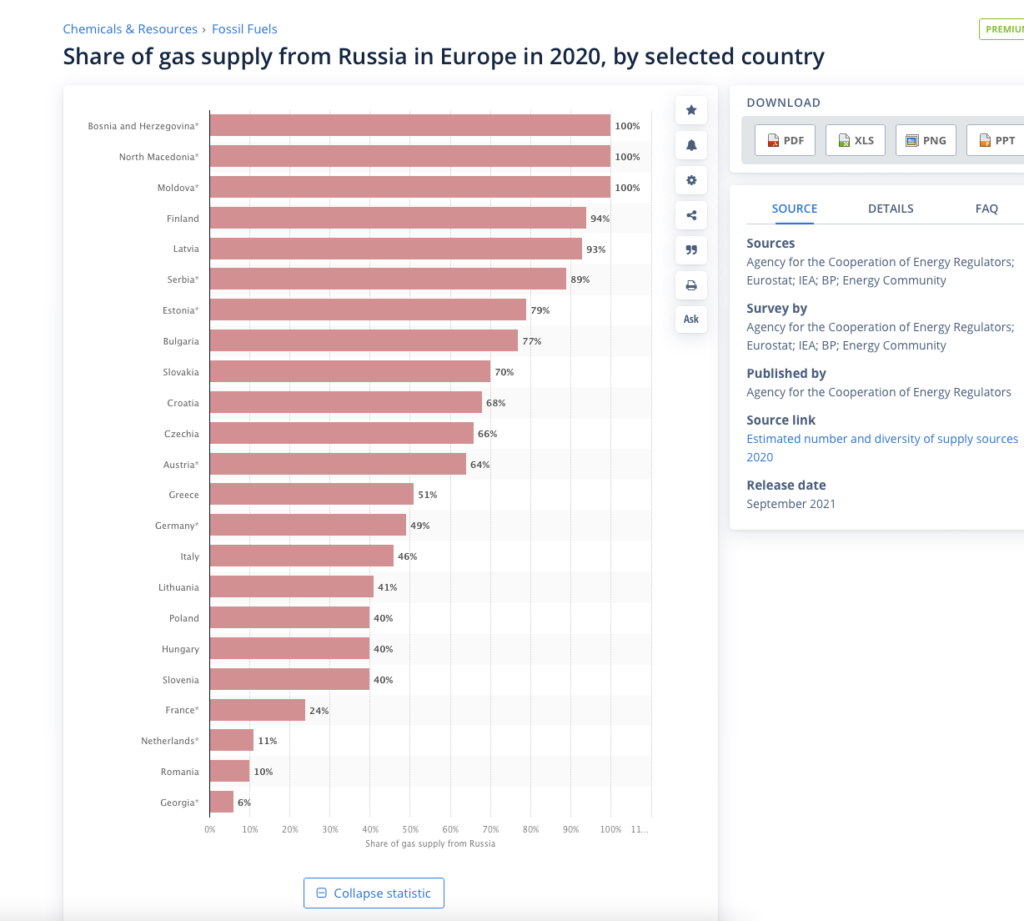

In general, the dependence of the whole of Europe on Russian gas is assessed as quite critical for our region. Look at this plate:

In general, the first 15 countries may be very worried about the well-established supply of Russian gas. In reality, when Russia is under massive sanctions, I believe that there are few arguments left for Russia to continue supplying it.

The situation in our countries was not easy even without the war, but now it becomes clear that gas prices can be increased X times (unfortunately, it is difficult to predict how many times, I know that only at times). An alternative could be deposits of natural gas, which is enough for us.

Job loss and unemployment

And without that, breathable exports for our region (the Baltic states) finally lost a huge sales market. Many industries are now in total shock: construction, transport (especially railway lines), tourism, the agricultural industry, and so on. Europe bought fertilizers from Russia, and Russia also did not have its own seeds or their germinating properties are much weaker than imported ones. It is not known who the sanctions will actually hit harder, but the fact remains the following: our region has lost a huge sales market, which means that there will again be an increase in unemployment in these sectors.

Stagflation

The most dangerous manifestation of inflation. Stagflation occurs when an economic recession is accompanied by high inflation. When there is less and less money, but at the same time prices are rising everywhere.

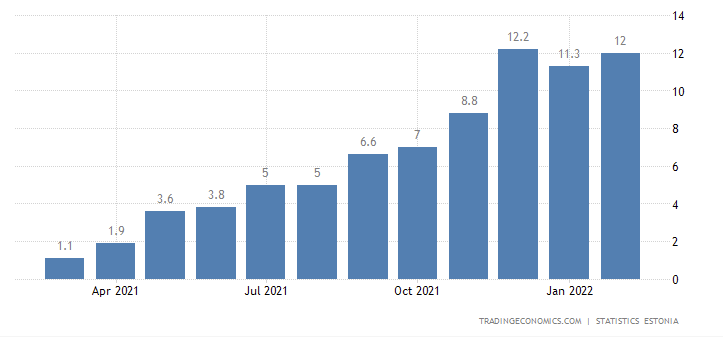

How do you like the next plate above? Let me remind you that 12.2, 11.3 and 12% are months to start of geopolitical events! We already had serious problems with inflation, and now, against the background of the fact that all raw materials will invariably rise in price due to sanctions and shortages, this will have its own round of development of inflationary processes. At the same time, we are still in a recession! The already small exports of Estonia are closed to one market, many sectors are waiting for the reorganization and redistribution of resources, plus banks should eventually raise their interest? So it turns out that it seemed that we should have experienced a cooling of the economy, but the most negative scenario happened - stagflation.

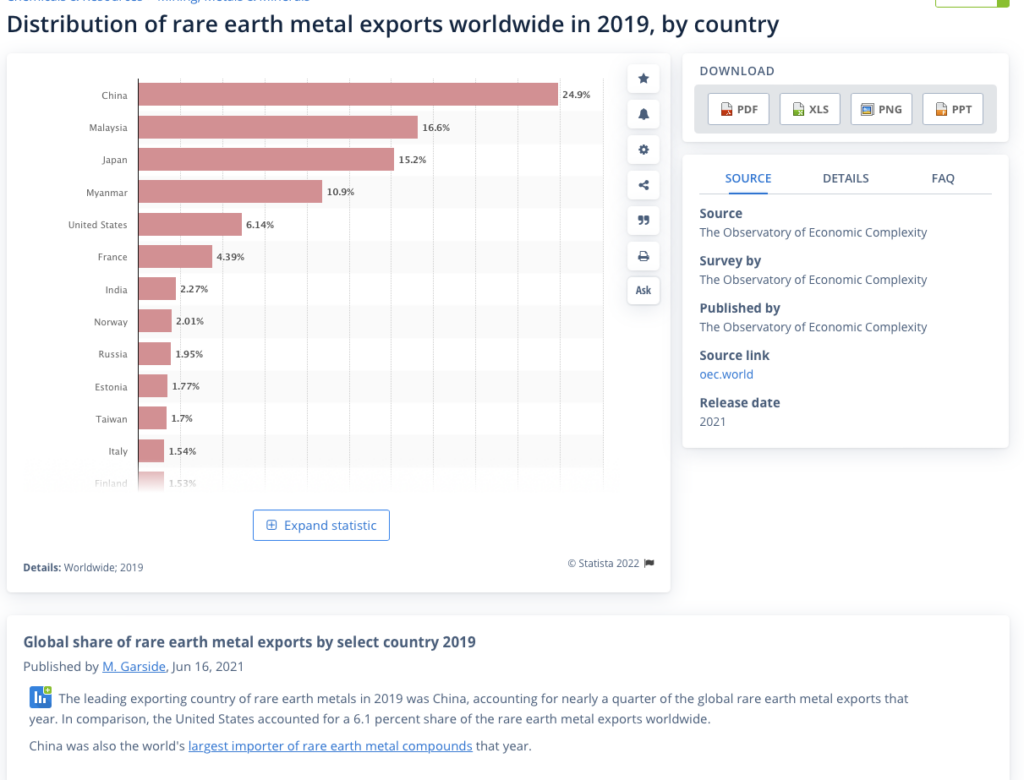

Shortage of precious metals and raw materials

Moreover, the investment hype is understandable, people are returning to the roots again, that gold should be a safe haven for investors in order to wait out times of crisis. But much more terrible is another fact, Russia is a significant exporter of precious metals for our region in particular.

It is possible that China will be able to fully cover the share of Russia, but this will take time. It is also important to take into account the accessibility and proximity to the border for the Baltic states. In addition, how to deliver through China? Russian paths will be closed for us...

Hence the following conclusion. Prices for all types of precious metals will go up.

Collapse of delivery times and increased transport costs in all sectors of the economy

Actually, we are smoothly moving on to what I already mentioned 2 construction sites above. All major trade routes ran through the railroad. And God bless her with Russia, but there is also China?! Yes! After all, the whole way to Europe from China lies through Russia, and it is unlikely that a country under so many sanctions will accept transit trade with “unfriendly” countries in a friendly way? How will we live then?

What to do with investments?

The complexity of the whole situation is understandable. The black swan happened. What will happen to the markets? They have already drunk for the fate of the Russian marketbut what are we to do?

At first, I was overcome by negative thoughts, but a few interesting things seem to emerge:

- U.S. Oil Companies Benefit Big from New Prices

- Green energy is also not far behind. In the event of a large-scale energy crisis, green energy issues are increasingly on the agenda.

- The property is still valued. Maybe the situation with the military operation does not betray confidence, but inflation makes real estate quite “delicious”.

- Gold, silver and other precious metals. They can be a safe haven.

- Inverse ETFs and ETFs that bear the market

- Market neutral strategies through options.

Conclusions

Key takeaways from the entire article:

- it looks like Russia's default is inevitable.

- our region is now definitely in recession

- the stock market is expecting a correction, it has just begun

- there are serious concerns about the energy crisis in Europe

leave a comment