The current situation in the financial markets is reminiscent of 1999, namely the dot-com bubble, when a .com domain name was added to any company and site and its share was growing rapidly and there was quite a logical justification for this. People worried about missed opportunities (FOMO effect = Fear Of Missed Opportunity = fear of a missed opportunity) and invested in any assets that showed promise for significant growth. At the time, dot-coms were such a sweet haven.

According to business statements (aripaev) this year, the so-called mega-financial circles, that is, where more than 100 million dollars have been invested, have especially grown. In total this year there were 751 such participants for half a year. Last year, there were 665 such investments for the entire year. 249 new companies have already achieved unicorn status this year (again, keep in mind that this is only half a year!), and that is already twice as many as last year.

It turns out that investors have plucked up courage and are ready to invest more and more amounts, as they manage to take their interest back from the markets. It is not surprising when the markets have already lost any connection with the real price and are growing due to the expectations of incoming players who are ready to buy at new maximum prices.

Unhealthy signals that bother me

Let's go through the different signals that we can see in the market.

- Number of SPACs

Let's pay attention to the following unhealthy situation and we will start with SPAC. In this article, we will not go into details of what SPAC is. You can find out more about this hence.

You look at 2021 and 2020. In 2021, in half a year! 368 SPAC companies have already come out. For the whole of 2020, 248 were already published, almost 5 times more than a year earlier. Moreover, the popularity of this method of entering the market is determined by the presence of extra money from investors and the lack of a sense of real risk. It will be a surprise for you, but out of 368 SPAC companies, only a couple of companies will continue their activities in a year or two, while the rest will simply burn through all the investments.

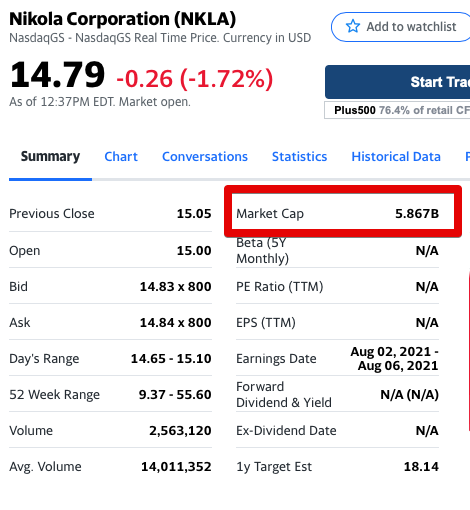

And there is a very real example of this - Nikola. The company's management did not hesitate to deceive the community about the existence of a supposedly working model of the product. Here we leave a link to New York Times. The company does not make money, it does not even have a working prototype, but for some reason it costs $5.8 billion and in some places even reached $30 billion. Do investors believe in the ability of this company to ever start making money?

- What's the SPAC, look at the IPO madness!

I cannot but agree that today it is profitable to participate in an IPO absolutely in any case. It doesn't matter which company enters the market. Even those that sometimes raise doubts about the viability of the idea and the ability to compete in the market are collected by initial subscriptions 3,2 more money than they planned! Yes, I'm talking about our particular example on the Baltic Exchange - Elmo Rent, but damn it, not only was it noted 3,2 times more than the company intended to receive at the beginning, but on the first day of trading, the company's shares rose by 70%! The feeling that the virtual belonging of investors to this company is more important than the products of paramount importance.

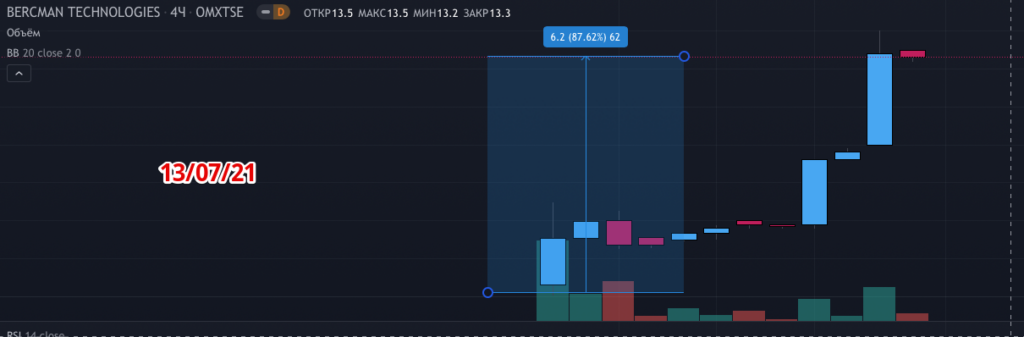

Okay, Elmo Rent, but for example Bercman. Fortunately, at least the company itself is cool, which provoked even greater rush demand for the company's shares. It was signed 14 times more than desired, what can we say about 87,62% an increase in the share price in the next few days after going public.

And do not limit your flight of fantasies, even though I gave an example of only two companies on the Baltic Nasdaq Stock Exchange, similar events are taking place in the US and UK markets. What is not the last example for you with Wise (formerly Transferwise)?

- The popularity of financial markets is growing at a record pace among retail investors.

According to Vanda Research, US retail investors in June placed on the stock market record 27,9 billion dollars. This amount also exceeded the amount of money put on the market in January during the explosion of meme stocks. It is estimated that over 10 million new investment accounts have been opened this year, the same number as in all of last year!

Moreover, such an optimistic background remains only among retail investors. Fund managers and institutional investors are in a very different mood. Compared to retail investors, professional fund managers are far more pessimistic, believing that future returns will be hampered by fears of inflation and already inflated company valuations.

But retail investors are not bothered by anything. They remain optimistic, although, for example, AMC shares, which experienced euphoric growth, are now far from the peak. AMC Entertainment Holdings, which became popular on the forums, fell by 28% compared to the daily peak in early June, and many beloved dogecoin fell by 71% from the May record.

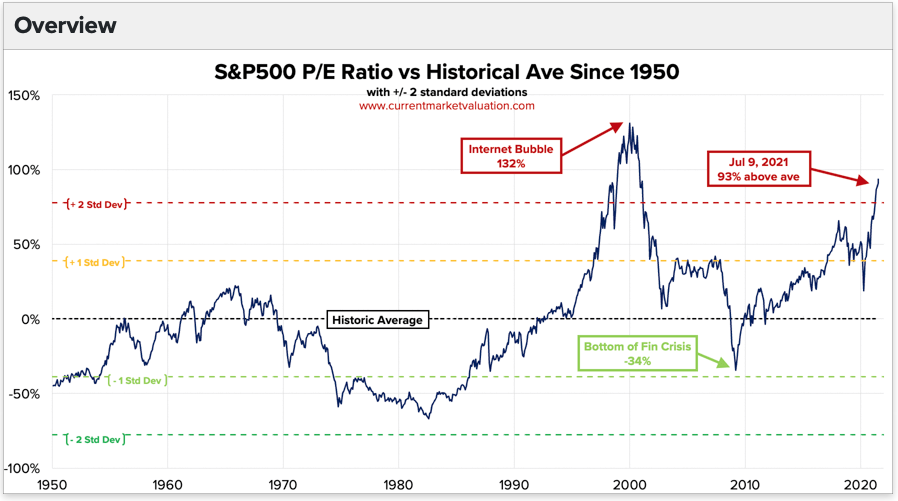

- Me REALLY concerned about the S&P500 P/E ratio

Often used in fundamental analysis P/E ratio - the ratio of the company's capitalization to its net profit. Let's take a look at what is happening in the most popular S&P500 index, which includes companies with the largest capitalization.

Have you noticed July 9th? Yes, we have long been out of touch with reality. The capitalization of all companies is already 2 standard deviations from the norm and is not far from the dot-com levels.

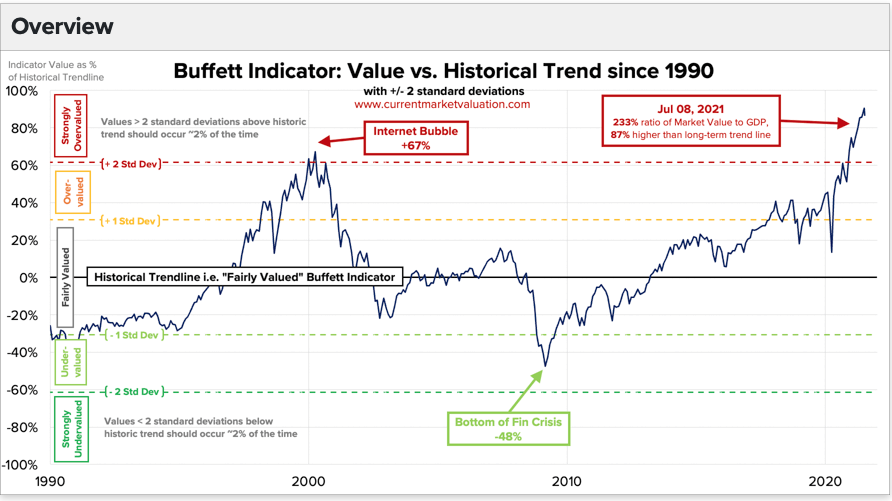

- Warren Buffet smart guy

To be honest, this paragraph should be a continuation of the previous argument, but one more index that I want to pay attention to, namely the Warren Buffet indicator, turned out to have a too sonorous name. At its core, the Buffett indicator is the ratio of the total value of the US stock market (all its companies) to the GDP of all countries. It should be extremely clear to you that the GDP of all countries cannot be less than the value of all US companies, right? Yes? Then look at the chart below.

I refer to the same site. In July 2021, we have already exceeded the milestone that was during the dot-com crisis in 2000! The value of all US companies exceeds 2 times the value of the GDP of all countries combined. It's just crazy!

The figure is estimated to be about 2,8 standard deviations above the historical average, indicating a strong market overvaluation. These are historical record highs. However, given historical lows in interest rates, there is reason to suspect that “this time is different” may be true, but for how long?

- The people lost their fear. Leveraged trades and option trades

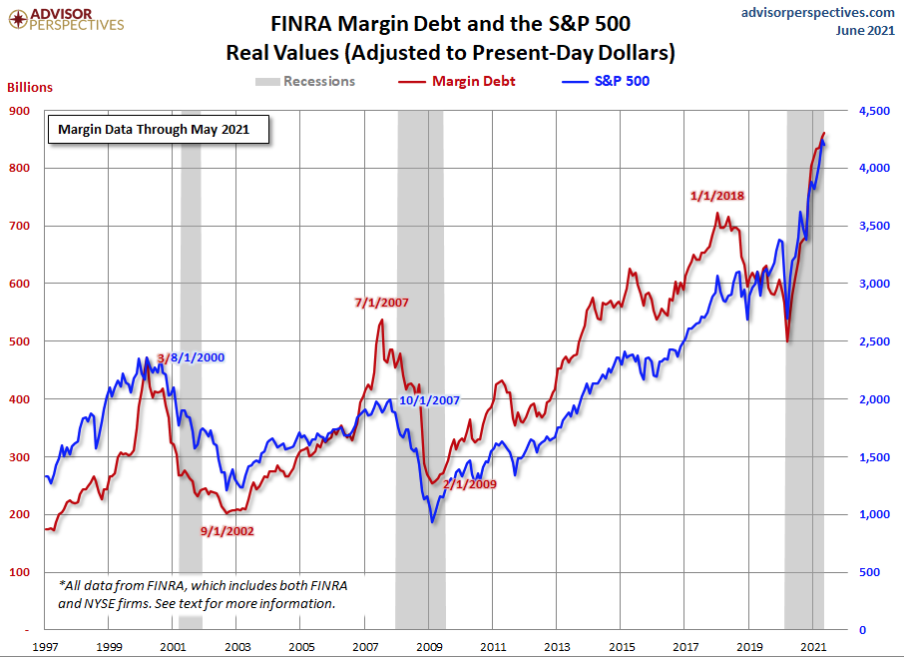

According to the classics of any financial bubble, people have a lot of money and completely fight off the fear of the risk of losing their finances. Hence the resulting transactions with leverage or additional risks that investors take on when trading with financial assets. Let's see how much money investors were willing to put up for the riskiest transactions with leverage.

Recessions are marked in gray. Investors are breaking new records in terms of risky trading volumes and by mid-2021 we are approaching $850 billion in options debt.

- What does the Fed, aka the FED, do?

And the Fed flooded the financial markets with stimulus packages for both companies and individuals. Individuals were generally given $1400 in stimulus checks and flooded the market with an additional $391 billion. The FED is creating excess liquidity in the markets as all the private investors rushed to put all their money where? Right! To the financial markets! And the Fed keeps interest rates at zero and does not raise them even against the backdrop of threatening inflationary processes.

- By the way, yes! Inflation!

And it begins to seriously threaten the well-being of the economy. According to the latest article cnbc inflation is at its highest level since 2013.

Despite assurances from the Federal Reserve that the current inflationary pressure will not last long, consumers see things differently. The June survey of consumer expectations showed that median inflation expectations over the next 12 months jumped to 4,8%, up 0,8 percentage points from May and the highest since 2013.

At the same time, the Fed has not yet changed interest rates and has not tried to extract excess liquidity from the markets, which means that the feast will continue further.

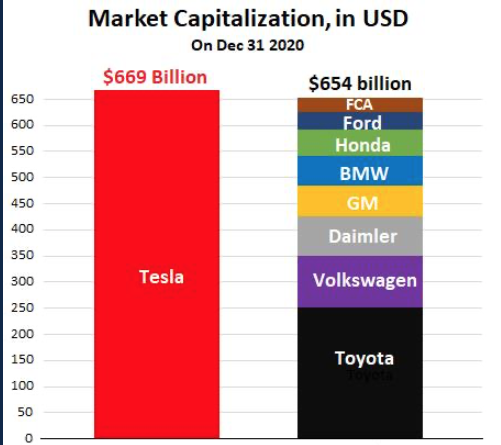

- Another частный an example of madness is Tesla!

This is a phenomenon and apotheosis among all companies in the financial markets. Company does not earn, but just look at how investors rated it:

Tesla's capitalization exceeds the value of all car companies in almost the entire world. A similar situation can be found in many other companies, for example, in the energy sector. This is not a one-off example of a single stock, it is almost a rule that start-up companies have a capitalization higher than that of their stable competitors from the same industry.

Financial crisis 2021? 2022?

I don't know about you, but for me it's a fact. A year earlier, financial markets did not want to recognize the global crisis, but all indicators are already screaming that the situation has long lost touch with reality. I don’t know how long this will last, years may pass in anticipation of the next black swan, or maybe everything will happen rapidly tomorrow. The fact is that financial bubbles and subsequent crises were accompanied by several unifying factors:

- The opinion that the bubble will not burst and that the market situation remains more or less healthy

- Low interest rates and easy money.

- Record number of SPACs

- Record number of IPOs and DPOs

- Record interest of the population in investments, which is expressed in the number of open investment accounts

- Growth of margin debt / debt on deals with leverage or options

- Indicators that are in the red zone. Such as the S&P500 P/E ratio and the Warren Buffet indicator.

- A firm belief that the Fed will save the situation and be able to raise rates in time and save us from a crisis or hyperinflation.

- Excessive demand for popular assets that are on everyone's lips. Cryptocurrencies, Tesla, green energy?

And now, if you reconsider the arguments in the article, do you find anything in common?

leave a comment