Briefly (key findings)

Consider the following speculative idea: buy stock in The Walt Disney Company (DIS) and wait for it to rebound.

The bottom line: May allow you to get up to 30% recovery.

The reason for the growth of shares – Disney shares down 27% due to renewed growth in Covid infections and weak FY4Q21 results

The plan: buy shares today at $147 and below if possible.

Risk or next support line: Stock could drop to $118 (18% loss)

We believe that the problems associated with the pandemic are temporary and forecast that the company will increase profits by 90% y/y by the first fiscal quarter of 2022 and that at current prices, The Walt Disney Company shares look attractive to investors. In the short term, the main growth drivers may be the release of new blockbusters in late 2021 and in the first quarter of 2022 (West Side Story, releases from Marvel, Star Wars, Pixar and Nat Geo). Plus Disney is a serious competitor to Netflix'y.

Recovering from the pandemic will help to reopen the amusement parks.

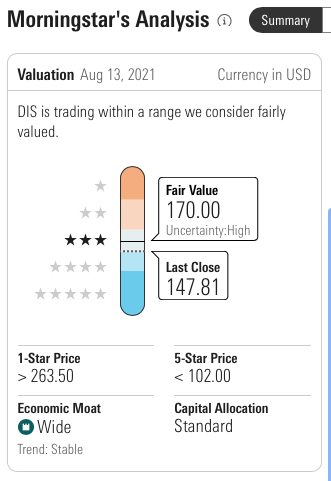

Disney Service plus is only available in just over 60 countries so far, many of which were added in 2020 and have not yet been able to affect financial performance. Even with a slower-than-expected increase in subscriptions in Q3 2021, we still see strong long-term growth in their services. Morningstar gives a fair share price of $170.

Of course, profits are still greatly pumped up due to the impact of the pandemic, but the company continues to increase sales in such a difficult situation, and this is the basis on which we believe that the company will be able to recover profits lost after the pandemic.

Risks

We see a rather serious risk in D / E or in the company's debt load, which turned out to be due to the fact that Disney absorbed 20th Century Fox in 2019. As of 3Q 2021, the company's debt was at $56 billion and net debt was $40 billion. The Debt/EBIDTA multiplier is 5.6, which is undoubtedly another unhealthy signal for investors. Plus, the company has suspended dividend payments to pay off debt and survive the pandemic. Also, Alexander's favorite program 🙂 (#investornameless) Buy Back - the reverse sale of shares - has been suspended. For many, paying dividends was a key argument to hold long positions. So far, it is impossible to say with absolute certainty that the company will restore dividend payments, but we believe that with the restoration of profits, this will again be on the agenda.

It should also be taken into account that if the company has no (serious) competitors in the amusement park segment, then there are a lot of analogues in the video streaming segment and there are already serious competitors such as Netflix, Amazon Prime, HBO and so on. Likewise, Sony, Roku, ViacomCBS and Comcast, which are now leaders in cable streaming, broadcasting and distribution of video on familiar physical media, do not sleep.

To summarize

Now shares can be purchased at a price of 144 dollars. And then one of the following options may arise:

- Wait for growth to $170. Shares had a similar value in September.

- Falls to the level of 118 dollars.

leave a comment