Tough time for this asset, caused by the fall of the top 3 exchange (FTX) and Bearmarket (the time when assets fall sharply in price by 20% or more)

Let's start with tokenomics. According to Messari, there are almost no locked coins left from the sale at the ICO (initial offer) - only a few million SOL from the founders of Solana are waiting for the unlock before the end of this year.

The only organization with a large token lock is Alameda, which bought coins directly from Solana funds (not with ICO) - a balance of about 48 SOL with locks until 000-000.

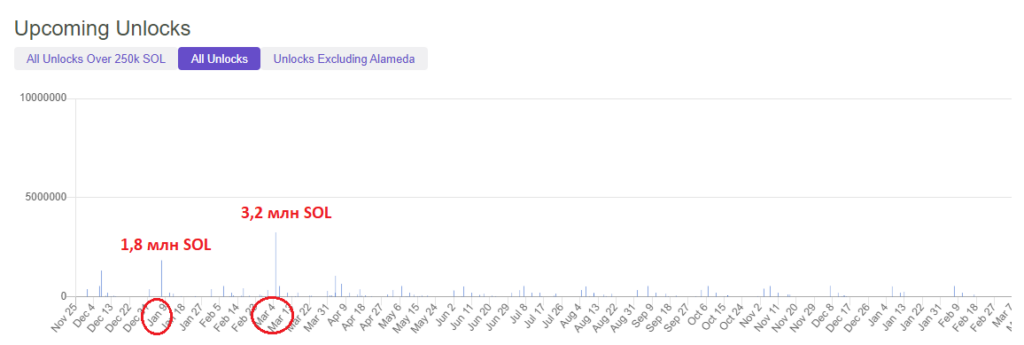

According to Solanacompass, total such locked coins, including Alameda, 74 SOL. About 000 - 000 SOL are poured per month. A couple of major exceptions are in January and March 1 (that's Alameda), as in the chart (below) - further without such major breakdowns in relation to the big picture.

Approximate inflation in the token is about 6%, which is 26 million SOL per year or 2,1 million SOL per month. Together with the unlocks, it turns out that about 3,5-4 million SOL are poured into the market every month.

This is NOT a very scary picture. With due community interest, all this can be smoothed out without much price loss for the token. Although, if we take into account that there are only 105 SOL in the market, then this is 000-000% monthly, and this is not so pleasant.

Solana's main problem is different. Total coins in the network - 533 SOL (so far). Solana has 000 tokens in stake. From here we subtract 000 SOL located in locks.

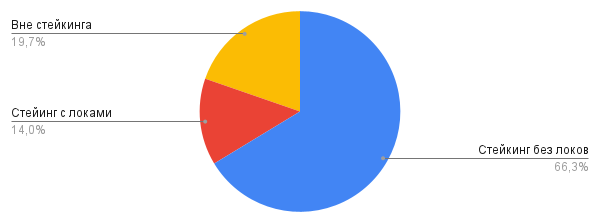

In total, we have 353 SOL in stake, which can be withdrawn very quickly, plus only 500 SOL are traded on the open market

And here we can talk about the problem. Only ~20% SOL is traded on the market. Another ~66% can be withdrawn from staking within 2-7 days. Perhaps there are some technical limitations. However, we saw the Solana fund withdraw its ~30M SOL from staking in the first half of November 2022.

All this only suggests is that the real supply of SOL on the open market could double or triple in just a week.

For better understanding. Today on exchanges in DeFi and 105 SOL are traded, in a week 000 SOL can be traded. And if you sell on the market, then the price will fall much lower than twice. Even 000% additional coins on the market will have a significant impact on the price.

Changes can occur both in a few days, and with long-term pressure on the market.

I will not talk about some technological innovations and decentralization, which does not exist.

Против Solana, or rather its token, is NOW an unsafe investment, without the ability to predict the emission and behavior of stakers (these are people). A time gap of 2-7 days is too little leverage to respond to a change in emission (issuance of tokens - in the crypt). No technological bullshit in the form of transaction speed will save the deposit.

Behind. When will Solana become interesting for a long-term purchase? (not about speculation - these are different things). As soon as Solana figured out how to disable the stakers. A good example of Ethereum is to completely close the withdrawal of coins from staking for 1-2 years

What is fundamentally good about Solana? If you're willing to take the risk described above, the only real selling point here is the huge community of users and developers in the ecosystem.

No manufacturability, speed, low transactions will replace users and developers.

And now, an excellent stress test for the survival of the Solana network has just formed.

What to watch? It is enough to look at metrics like TVL (the number of funds blocked) in DeFi, the number of active developers, the number of coins held in staking and the dynamics of this metric. All these data are released as weeklies on the official site Solana.com.

Don't bother with tech stuff at the bearmarket (although Solana tech is hoo). If there is money in the project, and more importantly, active users with money, then the project will live, the token will grow, and the ecosystem will flourish. The local price means nothing.

Sources: Messari, solanacompass, Solana.com

leave a comment